The Global Cocoa Market in 2026

A Comprehensive Analysis of Production, Prices, Supply-Demand Dynamics, and Industry Outlook

Market Analysis | February 2026 | Funui Donard

Executive Summary: Key Market Insights at a Glance

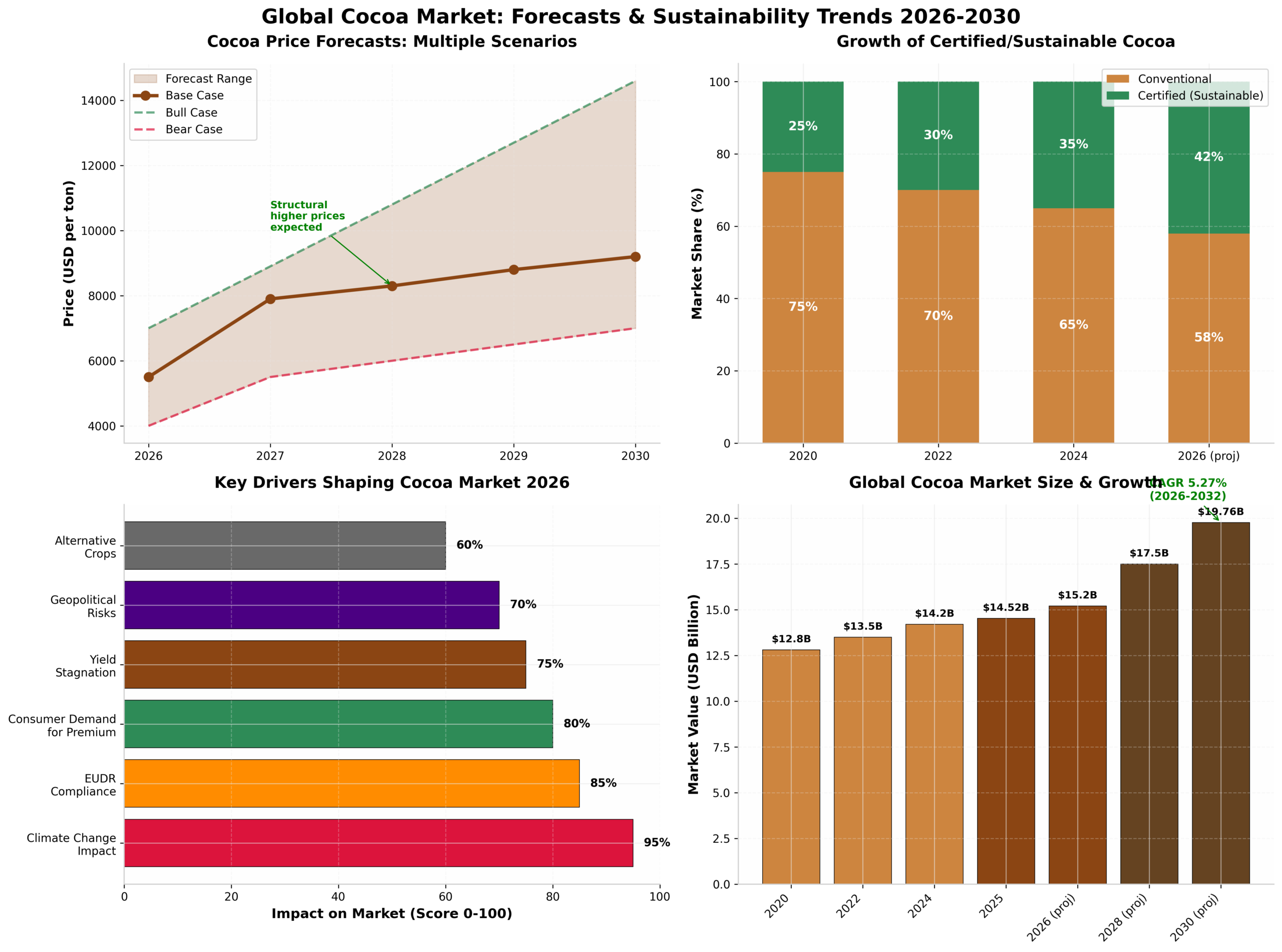

The global cocoa market in 2026 finds itself at a pivotal crossroads, transitioning from the acute supply crisis of 2024 into a period of cautious stabilization. After experiencing historic price volatility that saw cocoa futures briefly surge above $12,000 per tonne in early 2025—the highest levels in decades—the market is now showing signs of recovery as favorable weather conditions in West Africa and expanding production in Latin America help rebalance supply and demand.

However, this recovery is fragile and comes with significant caveats. The market faces structural challenges including aging cocoa trees in West Africa, persistent climate volatility, crop diseases, stringent new EU regulations on deforestation (EUDR), and the need for greater sustainability throughout the supply chain. While prices have retreated from their extreme highs, they remain structurally elevated compared to the previous decade, and industry analysts don’t expect a return to historical price levels anytime soon.

This comprehensive analysis examines the global cocoa market in 2026 through multiple lenses: production and consumption patterns, price dynamics, regional supply shifts, sustainability imperatives, and future outlook.

🌍 Global Market Overview: Size, Growth, and Structure

Market Size and Growth Trajectory

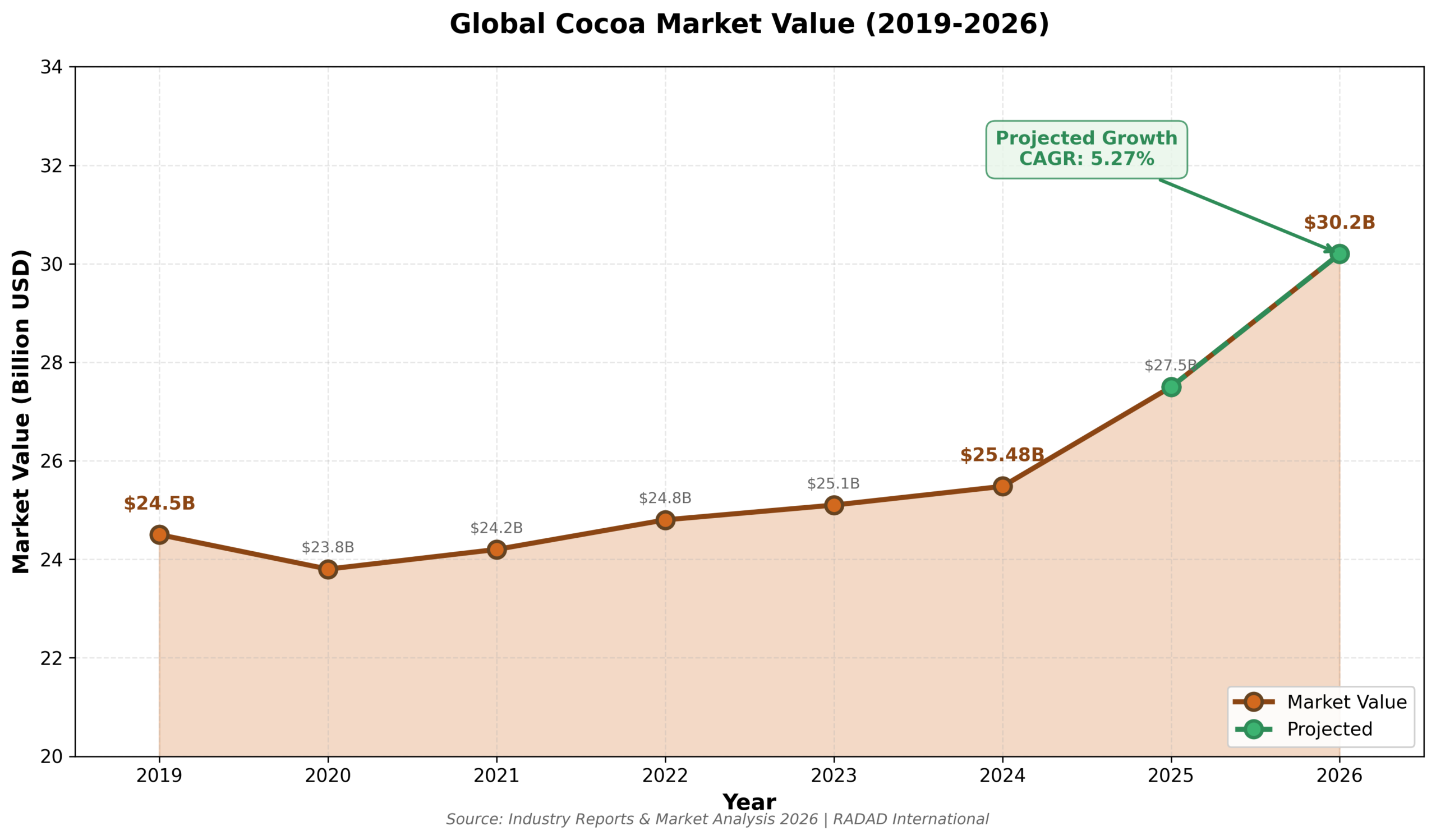

The global cocoa products market was valued at approximately $24.5 billion in 2019 and has shown steady growth despite recent volatility. Market forecasts project the sector will reach $30.2 billion by 2026, representing a compound annual growth rate (CAGR) of approximately 3.1% from 2019 to 2026. This growth is driven by sustained consumer demand for chocolate and cocoa-based products, expanding applications in pharmaceuticals and cosmetics, and rising consumption in emerging markets particularly across Asia and Latin America.

More recent analyses from 2024 show the cocoa market reaching approximately $25.48 billion in 2024, with expectations for continued expansion fueled by the robust growth of e-commerce, increasing focus on premium and sustainable products, and technological innovations in processing and distribution.

Production and Consumption: The Supply-Demand Balance

The cocoa market’s fundamental dynamics revolve around the balance between production (supply) and grindings (demand). “Grindings” refers to the processing of cocoa beans into cocoa liquor, powder, and butter—a key indicator of global demand from chocolate manufacturers and other end-users.

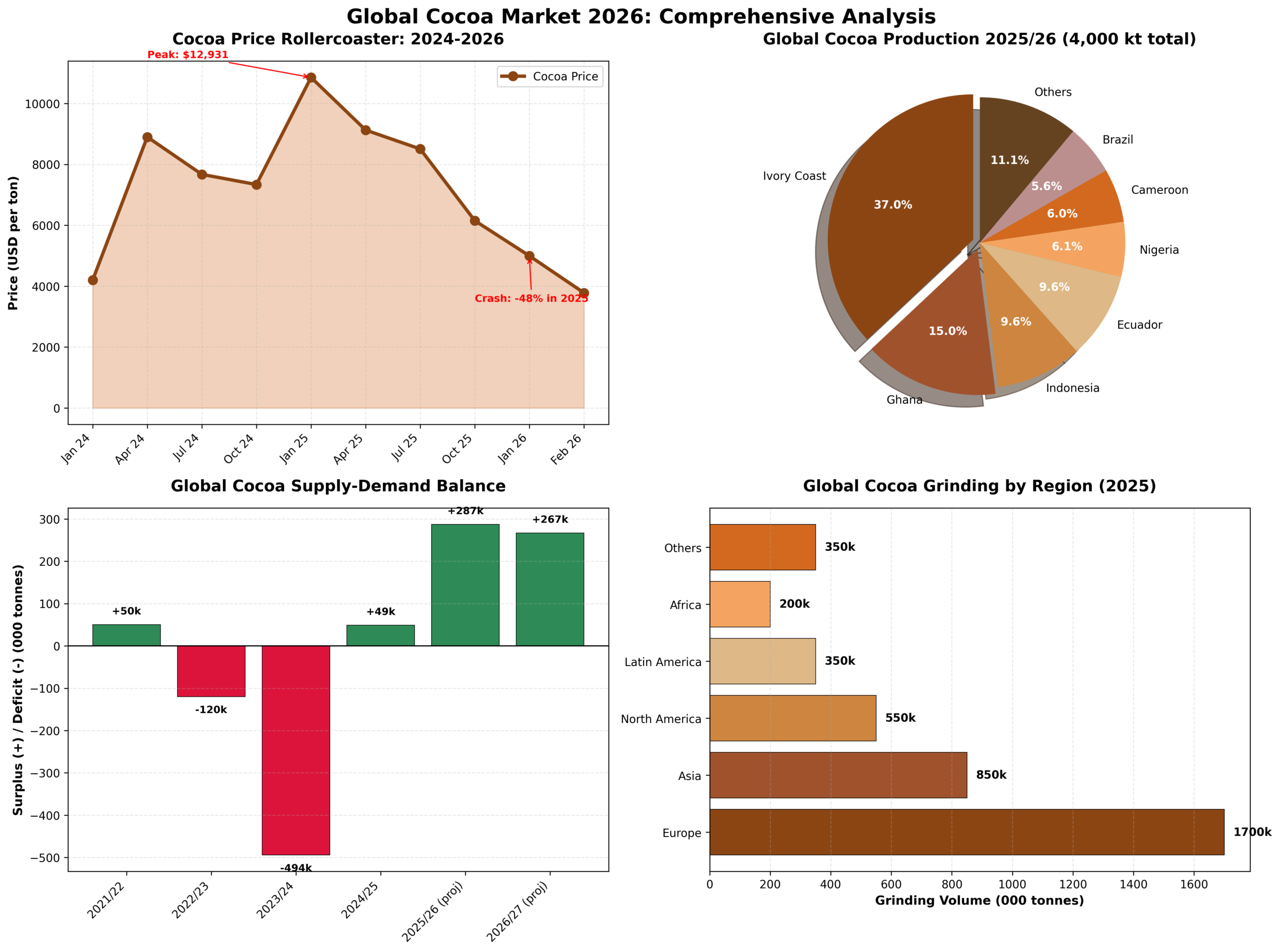

According to the latest data from the International Cocoa Organization (ICCO), the 2023/24 cocoa season closed with a substantial deficit of 489,000 tonnes—one of the largest deficits in recent history. This massive supply shortfall was primarily driven by poor harvests in West Africa due to adverse weather conditions, aging trees, and the spread of crop diseases.

However, the 2024/25 season shows a dramatic reversal, with ICCO forecasting a surplus of 49,000 tonnes. This shift represents the first surplus in several years and reflects improving weather conditions, better crop management, and demand destruction caused by historically high prices in 2024.

| Season | Global Production (tonnes) | Global Grindings (tonnes) | Balance (Surplus/Deficit) |

|---|---|---|---|

| 2022/23 | 4,449,000 | 4,880,000 | -431,000 (Deficit) |

| 2023/24 | 4,489,000 | 4,810,000 | -489,000 (Deficit) |

| 2024/25 (Forecast) | 4,840,000 | 4,650,000 | +49,000 (Surplus) |

| 2025/26 (Projection) | ~5,000,000 | ~4,700,000 | +287,000 (Surplus – StoneX) |

Source: International Cocoa Organization (ICCO) Quarterly Bulletin of Cocoa Statistics, February 2025; StoneX projections

The shift from deficit to surplus is significant but comes with important context. The 2024/25 surplus is achieved not just through production increases (+7.8% year-over-year) but also through demand destruction—global grindings are projected to decrease by 4.8% as high cocoa prices forced chocolate manufacturers to reduce production, reformulate products, or pass costs to consumers who then reduced purchases.

💡 Key Insight: The Demand Destruction Effect

High cocoa prices in 2024 and early 2025 had a measurable impact on global demand:

- European Grindings: Declined 7.2% year-over-year in Q2 2025

- Asian Grindings: Collapsed 16% year-over-year in Q2 2025 (13% below industry expectations)

- Overall Q2 2025 Grindings: Fell nearly 5% globally

Consumers in price-sensitive markets reduced chocolate purchases, switched to lower-cocoa formulations, or substituted with alternative treats. This demand response, combined with production recovery, is helping rebalance the market—but at the cost of reduced industry activity and chocolate consumption.

💰 Price Dynamics: From Historic Highs to Correction

The 2024-2025 Price Rollercoaster

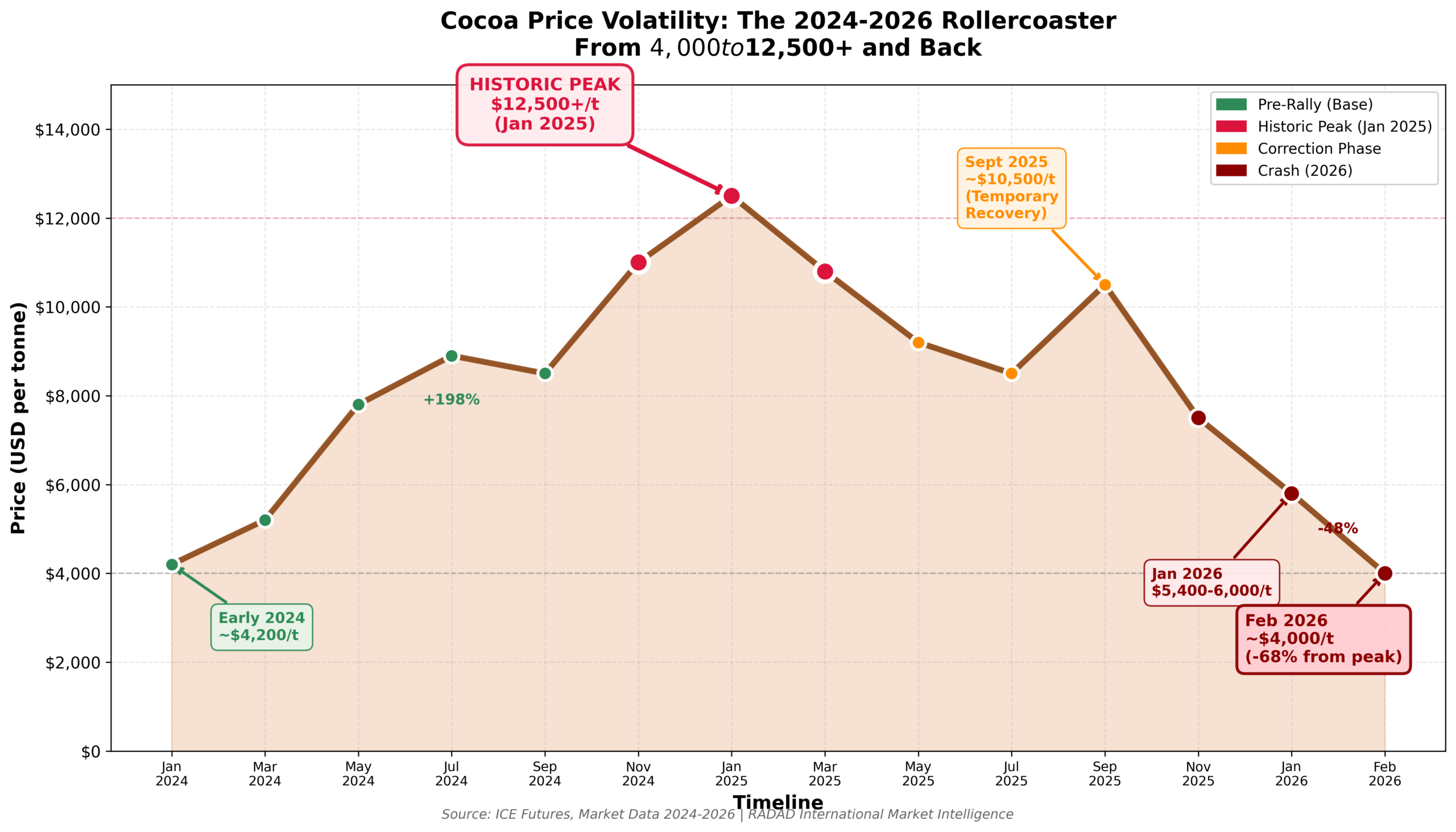

The cocoa price story of 2024-2025 is one for the record books. Driven by severe supply constraints, cocoa futures on the London (ICE Futures Europe) and New York (ICE Futures U.S.) markets experienced unprecedented volatility:

- Early 2024: Prices began rising steadily as poor harvest forecasts from West Africa emerged

- Late 2024: Prices surged past $10,000 per tonne as the full extent of the supply deficit became clear

- Early 2025 (Peak): Cocoa futures briefly exceeded $12,000 per tonne (over $12/kg)—the highest levels seen in decades, making cocoa one of the best-performing commodities of the year

- Mid-2025: Prices began retreating as improved weather forecasts and demand destruction took effect, falling approximately 12% in September 2025

- Late 2025: Continued decline as favorable weather supported better harvest prospects

- January 2026: Prices dropped more than 10% year-over-year in the first 12 days, settling around $5,400-$6,000 per tonne according to ICCO daily price data

- February 2026: Further decline to below $4,000 per tonne in some trading sessions—the lowest since October 2023

What Drove the Price Spike?

🌦️ Supply-Side Factors

- West African Weather: Erratic rainfall, prolonged dry spells, and droughts reduced yields in Côte d’Ivoire and Ghana

- Crop Diseases: Cocoa Swollen Shoot Virus (CSSV) and other diseases devastated plantations

- Aging Trees: Many cocoa trees in main producing regions are old and less productive

- Input Costs: High fertilizer and pesticide prices limited farmers’ ability to maintain productivity

- Deferred Maintenance: Years of low prices meant farmers couldn’t invest in tree replanting or farm improvements

📈 Demand-Side Factors

- Strong Chocolate Demand: Robust consumer appetite for chocolate products globally

- Inventory Rebuilding: Buyers attempting to restock after previous shortages

- Speculative Activity: Financial investors entering the market amplified price moves

- Low Stockpiles: End-of-season stocks fell 28% to 1.27 million tonnes in 2023/24

- Stocks-to-Grindings Ratio: Dropped to just 26.4%—indicating tight supply relative to demand

The Current Price Correction

The substantial price decline from $12,000+ to around $4,000 per tonne represents one of the sharpest corrections in cocoa market history. Several factors are driving this adjustment:

🔄 Factors Behind the Price Correction

- Improved Weather Forecasts: Better rainfall patterns in West Africa, particularly Côte d’Ivoire and Ghana, suggest stronger harvests for the 2025/26 season. Early flowering indicators are showing promising signs.

- Supply Recovery: Global production is rebounding, with StoneX projecting surpluses of 287,000 tonnes for 2025/26 and 267,000 tonnes for 2026/27. This represents a dramatic shift from the deficits of previous years.

- Demand Destruction: High prices in 2024 forced consumers to reduce chocolate purchases, leading to weaker buying interest and stock accumulation among producers.

- Speculative Selling: As supply outlook improved, speculative investors who drove prices higher began exiting positions, adding downward pressure.

- Unsold Inventory: Both Côte d’Ivoire and Ghana are dealing with significant unsold cocoa. Côte d’Ivoire launched a strategic buyback operation in January 2026 to address thousands of tonnes sitting in warehouses. Ghana reportedly has about 50,000 tonnes of unsold cocoa at its ports, with international buyers turning away due to higher prices compared to beans from other origins.

- Competitive Pressure: As prices fell, buyers became more selective about origin and price, creating competitive dynamics that further pressured prices downward.

Expert Price Outlook for 2026

Despite the recent sharp declines, most analysts don’t expect cocoa prices to return to the historical lows seen in the 2010s. The consensus view suggests prices will settle at a “new normal” that’s higher than the past decade’s averages:

⚠️ Analyst Forecasts & Expectations

J.P. Morgan Global Research: “Despite the recent downtrend, J.P. Morgan Global Research expects cocoa prices to remain structurally higher for longer at $6,000 per tonne. Amid multi-season availability constraints, we hold our medium-term price forecast at $6,000/tonne while the market finds balance.”

Rabobank (Oran van Dort, Commodity Analyst): “With the 2025/26 and 2026/27 seasons expected to bring surpluses—driven by higher prices incentivizing a global rebound in production as well as demand destruction—we expect prices to trend downward as these surpluses materialize, assuming normal weather conditions. However, I do not expect prices to return to historical levels within the next year or two, as systemic supply-side issues in Côte d’Ivoire and Ghana will persist.”

Key Risks to Outlook:

- Weather Volatility: A single drought, heatwave, or excessive rainfall event could quickly tighten supply

- Low Liquidity: Reduced open interest in futures markets means higher volatility potential

- Depleted Stockpiles: Global inventories remain low, limiting buffer capacity

- Geopolitical Tensions: Could disrupt trade flows and supply chains

- EUDR Implementation: New EU regulations could disrupt supply as producers adapt to traceability requirements

🌱 Global Production Landscape: Key Producing Regions

West Africa: The Dominant Force

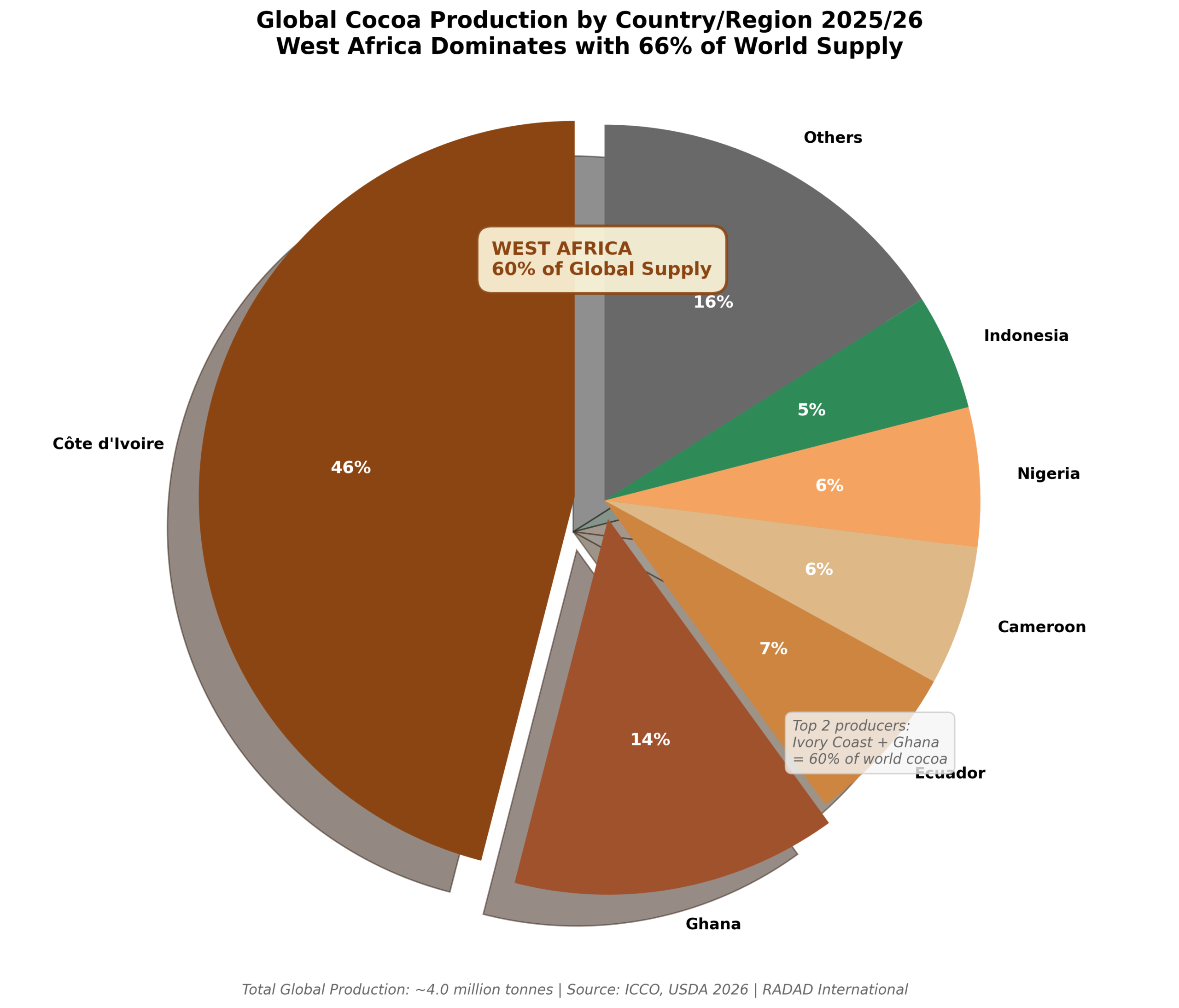

West Africa has been the epicenter of global cocoa production for decades, and this dominance continues in 2026 despite recent challenges. The region accounts for approximately two-thirds of global cocoa output, with Côte d’Ivoire and Ghana serving as the industry’s twin pillars.

| Country/Region | Production 2023/24 (tonnes) | % of Global Production | Key Characteristics |

|---|---|---|---|

| Côte d’Ivoire (Ivory Coast) | ~2,200,000 | ~45-48% | World’s largest producer; recent weather challenges; EUDR compliance focus |

| Ghana | ~650,000 | ~13-15% | Quality reputation; CSSV disease challenges; pricing competitiveness issues |

| Nigeria | ~280,000 | ~6% | Rising producer; potential for expansion |

| Cameroon | ~300,000 | ~6% | Fine flavor cocoa; sustainable practices focus |

| Ecuador | ~350,000 | ~7-8% | Fine/flavor cocoa; new plantings reaching maturity; expansion potential |

| Indonesia | ~220,000 | ~5% | Third largest historically; declining production |

| Peru | ~140,000 | ~3% | Organic and fair-trade focus; growing production |

| Colombia | ~70,000 | ~1.5% | Growing sector; government support programs |

| Others | ~279,000 | ~6% | Various countries in Latin America, Asia, Oceania |

Note: Production figures are approximate for 2023/24 season. Source: ICCO, industry reports

Côte d’Ivoire: Navigating Challenges

As the world’s largest cocoa producer, Côte d’Ivoire’s performance largely dictates global market dynamics. The country produced approximately 2.2 million tonnes in the 2023/24 season, though this was down from previous years due to weather challenges and disease.

For the 2025/26 season, early indicators are more positive. Farmers report sufficient soil moisture, and forthcoming rains are expected to strengthen crops and produce high-quality beans. However, concerns remain about poor storage conditions affecting bean quality, and some farmers are hesitant to harvest due to non-payment fears—a recurring issue when prices are volatile.

Côte d’Ivoire’s government has taken proactive steps, including:

- Launching a strategic buyback operation in January 2026 to purchase unsold cocoa from warehouses

- Implementing the African Region Standard (ARS-1000) for sustainability and traceability

- Working toward EUDR compliance to maintain access to European markets

- Raising farmgate prices (~20% increase in 2024/25 season) to share revenue with farmers

Ghana: Quality Reputation Under Pressure

Ghana, traditionally known for premium quality cocoa, faces multiple challenges in 2026. Production has declined to around 650,000 tonnes in recent seasons—significantly below the country’s historical output of 800,000-900,000 tonnes.

Key issues include:

- Cocoa Swollen Shoot Virus (CSSV): Disease has devastated plantations, requiring large-scale tree cutting and replanting

- Pricing Competitiveness: Ghana Cocoa Board (COCOBOD) acknowledges that international buyers are increasingly turning away from Ghanaian cocoa due to higher prices compared to other origins

- Unsold Inventory: Approximately 50,000 tonnes sitting at ports as of early 2026

- Aging Infrastructure: Trees and farming practices need modernization

However, exporters remain confident about harvest expectations for 2025/26, and the government has raised farmgate prices significantly (~60% increase in 2024/25) to incentivize farmers and share high market prices.

Latin America: The Rising Alternative

One of the most significant structural shifts in the global cocoa market is the gradual diversification away from total West African dependence toward greater production in Latin America.

🌎 Latin America’s Growing Role

Ecuador is emerging as a particularly important player. The country’s new cocoa plantings are reaching maturity, adding meaningful supply to the global market. Ecuador’s fine-flavor cocoa (Nacional/Arriba variety) commands premium prices and is increasingly sought by specialty chocolate makers.

Peru focuses heavily on organic and fair-trade production, carving out a niche in the premium segment. The country has shown consistent production growth.

Colombia is expanding its cocoa sector with government support programs aimed at diversifying agricultural production and providing alternatives to illicit crops. While still a smaller producer (~70,000 tonnes), growth potential exists.

Brazil has historically been a larger producer but faces challenges; nonetheless, it remains significant for South American supply.

According to Rabobank analyst Oran van Dort: “We appear to be in a period of transition, where global production is shifting away from [Côte d’Ivoire and Ghana] toward others, particularly Latin America and other West African nations.”

Global Consumption and Trade Patterns

Major Importing Countries: Where Cocoa Goes

While production is concentrated in tropical regions, cocoa processing and chocolate consumption are heavily concentrated in developed economies, particularly Europe and North America. The trade flow from origin countries to processing hubs represents a critical link in the global supply chain.

| Country/Region | Cocoa Imports (kg, 2021) | Primary Use | Key Characteristics |

|---|---|---|---|

| Netherlands | 1.2 billion kg | Processing hub | Europe’s largest grinder; Amsterdam port is global trading center |

| United States | Second largest | Processing & consumption | Major chocolate market; domestic grinding operations |

| Malaysia | Third largest | Processing for Asian market | Regional processing hub for Southeast Asia |

| Germany | Fourth largest | Processing & consumption | Major chocolate producer (Ritter Sport, Milka, etc.) |

| Belgium | Significant | Premium chocolate production | Renowned for luxury chocolates; high per-capita consumption |

| France | Significant | Processing & consumption | Strong confectionery industry |

| United Kingdom | Significant | Processing & consumption | Major chocolate brands (Cadbury, etc.) |

Source: Market data 2021-2022; ICCO trade statistics

Europe: The Processing Powerhouse

Europe remains the global leader in cocoa processing, supported by major grinders, established chocolate manufacturers, and sophisticated logistics infrastructure. The continent accounts for approximately 40-45% of global cocoa grinding, transforming raw beans into cocoa liquor, butter, and powder.

However, European grindings faced significant pressure in 2024-2025 due to high raw material costs. As noted earlier, European cocoa grindings declined 7.2% year-over-year in Q2 2025 as processors struggled with squeezed margins and manufacturers reformulated products or reduced production.

European markets are also at the forefront of sustainability requirements, particularly with the EU Deforestation Regulation (EUDR) coming into full effect. This regulation mandates that cocoa imports into the EU must be deforestation-free and fully traceable, fundamentally reshaping supply chain practices.

Asia: Fastest Growing Market

While Europe and North America dominate current consumption, Asia Pacific is the fastest-growing regional market for cocoa and chocolate products. Rising incomes, urbanization, westernization of diets, and growing middle classes in China, India, Indonesia, and other countries are driving rapid demand growth.

However, the Asian market also showed the greatest sensitivity to high prices in 2024-2025. Asian grindings collapsed 16% year-over-year in Q2 2025—13% below average industry expectations—demonstrating that price-sensitive consumers in emerging markets quickly reduce consumption when chocolate becomes too expensive.

⚠️ Critical Challenges Facing the Cocoa Industry

1. Climate Change and Weather Volatility

Perhaps no challenge looms larger for the cocoa industry than climate change. Cocoa trees (Theobroma cacao) are extremely sensitive to environmental conditions, requiring specific temperature ranges, rainfall patterns, and humidity levels to thrive. They grow within a narrow band roughly 20 degrees north and south of the equator—the “cocoa belt.”

🌡️ Climate Impact on Cocoa Production

- Erratic Rainfall: Inconsistent precipitation patterns—prolonged droughts followed by excessive rains—stress trees and reduce yields

- Temperature Extremes: Both excessive heat and unusual cold snaps damage crops and reduce bean quality

- Changing Seasons: Traditional wet and dry seasons are becoming less predictable, affecting flowering and pod development cycles

- Harmattan Winds: Dry, dusty winds in West Africa (November-March) can damage crops if excessively strong or prolonged

- Extreme Weather Events: Increasing frequency of storms, floods, and droughts disrupts production

- Long-term Viability: Studies suggest that by 2050, current cocoa-growing regions may become unsuitable for cultivation without significant adaptation

The 2023/24 season’s massive deficit was largely attributable to poor weather in West Africa. Conversely, the improving forecasts for 2025/26 are predicated on more favorable rainfall—illustrating how weather volatility creates boom-and-bust cycles.

2. Crop Diseases: The Silent Destroyer

Cocoa plantations face numerous diseases and pests that can devastate entire regions:

- Cocoa Swollen Shoot Virus (CSSV): Particularly virulent in Ghana, this disease has no cure. Infected trees must be cut down and burned, with surrounding trees often removed as well to prevent spread. CSSV has destroyed hundreds of thousands of hectares of cocoa farms in Ghana.

- Black Pod Disease (Phytophthora): Fungal disease that can destroy 20-30% of annual crop in affected areas, particularly during rainy seasons.

- Witches’ Broom (Moniliophthora perniciosa): Devastating in Latin America, this fungal disease caused massive production losses in Brazil in past decades.

- Frosty Pod Rot: Another fungal disease affecting Latin American production.

- Mirids and Other Pests: Insect pests that damage pods and reduce yields.

Controlling these diseases requires investment in monitoring, treatment, resistant varieties, and sometimes complete farm rehabilitation—expenses that many smallholder farmers cannot afford.

3. Aging Trees and Underinvestment

A structural problem across major producing countries is the prevalence of old, unproductive cocoa trees. Cocoa trees begin bearing fruit around 3-5 years after planting and peak in productivity at 10-15 years. Production declines significantly after 25-30 years, yet many trees in West African plantations are 40+ years old.

Replanting is expensive and requires farmers to forgo income for several years while new trees mature. During periods of low cocoa prices (pre-2023), farmers lacked the financial means to invest in rehabilitation. Even now, with higher prices, uncertainty about future market conditions and lack of access to credit make large-scale replanting difficult.

4. EU Deforestation Regulation (EUDR): The New Compliance Reality

The EU Deforestation Regulation (EUDR) represents one of the most significant regulatory changes to impact the cocoa industry in decades. Originally scheduled for implementation in 2024, the regulation has been delayed, with large companies and operators required to comply by December 30, 2026, and small/micro enterprises by June 30, 2027.

📋 EUDR Key Requirements

The regulation bans the sale, import, or export to the EU of products linked to deforestation or forest degradation after December 31, 2020. For cocoa (and coffee, palm oil, soy, rubber, cattle, wood), this means:

- Full Traceability: Every shipment must be traceable to the specific farm plots where cocoa was grown, requiring GPS coordinates of production areas

- Deforestation-Free Certification: Proof that land was not deforested or degraded after the cutoff date

- Risk Assessment: Operators must conduct due diligence to assess and mitigate deforestation risk

- Documentation: Comprehensive records proving compliance, subject to audit

- Penalties: Non-compliance can result in fines up to 4% of annual EU turnover, confiscation of goods, and market exclusion

Impact on Industry:

- Requires massive investment in farm mapping, GPS data collection, and digital tracking systems

- Smallholder farmers need support to provide required documentation

- Some origin regions may be excluded if compliance cannot be demonstrated

- Creates competitive advantages for well-organized, certified supply chains

- Drives consolidation and increased scrutiny of sourcing

The EUDR is becoming a market benchmark globally, with buyers outside the EU also adopting similar requirements. Producing countries like Côte d’Ivoire have developed national traceability systems (e.g., ARS-1000 standard) to facilitate compliance.

5. Farmer Livelihoods and Child Labor

Cocoa farming is challenging, labor-intensive work with historically low returns. Most cocoa is grown by smallholder farmers (farms under 5 hectares) who often live below poverty lines. Issues include:

- Low Income: Despite recent price increases benefiting exporters, farmgate prices (what farmers receive) often don’t provide living wages

- Child Labor: Persistent problem in cocoa-growing regions, with children sometimes working in hazardous conditions on family farms

- Lack of Education: Limited access to training on best practices, pest management, and sustainable farming

- Gender Inequality: Women often work on cocoa farms but have less access to land ownership, credit, and training

- Rural Infrastructure: Poor roads, limited healthcare, and inadequate schools in cocoa-growing areas

Addressing these social challenges is critical for long-term industry sustainability, as next-generation farmers will not continue in cocoa unless it provides adequate livelihoods.

🌿 Sustainability and Ethical Sourcing: The Industry Imperative

The Shift Toward Sustainable Cocoa

Sustainability is no longer optional in the cocoa industry—it’s becoming central to market access and brand reputation. The convergence of consumer demand, regulatory requirements (EUDR), investor pressure, and corporate commitments is driving fundamental changes in how cocoa is produced and traded.

Key sustainability trends in 2026:

- Traceability Systems: Blockchain technology, GPS mapping, and digital platforms enabling farm-to-consumer tracking

- Certification Growth: Fair Trade, Rainforest Alliance, UTZ, and Organic certifications expanding

- Agroforestry: Integrating cocoa with shade trees and diverse crops to improve environmental outcomes and farmer resilience

- Climate-Smart Agriculture: Drought-resistant varieties, improved water management, soil health programs

- Living Income Programs: Premium payments and income diversification helping farmers achieve decent livelihoods

- Transparency Initiatives: Major chocolate companies publishing supplier lists and sustainability progress reports

The African Region Standard (ARS-1000)

A significant development is the African Region Standard (ARS-1000), a producer-led sustainability initiative developed by Côte d’Ivoire and Ghana—the world’s two largest cocoa producers.

🌍 ARS-1000: Producer-Led Sustainability

Launched to align with global expectations (particularly EUDR), ARS-1000 establishes:

- Rigorous no-deforestation requirements

- National traceability systems tracking cocoa from farm to export

- Social responsibility provisions: Living incomes, child labor combat, farmer welfare

- Quality standards for premium cocoa

Early reports indicate that by 2023, over 80% of Ivorian cocoa in sustainability programs was already traceable to the farmer. This trend is expected to improve further under ARS-1000.

The significance of ARS-1000 is that it puts producing countries in the driver’s seat of sustainability, rather than having standards imposed by importing countries or multinational corporations. This promotes local ownership and ensures that sustainability approaches are appropriate for African contexts.

Corporate Sustainability Commitments

Major chocolate companies and cocoa processors have made ambitious public commitments:

- 100% Sustainable Sourcing: Companies like Nestlé, Mars, Mondelēz, Hershey, Barry Callebaut, and others have pledged to source all cocoa from certified sustainable sources by 2025-2030

- Deforestation-Free Supply Chains: Commitments to eliminate deforestation from cocoa sourcing by 2025

- Living Income: Programs to ensure farmers earn enough to afford a decent standard of living

- Child Labor Elimination: Monitoring and remediation systems to end child labor in supply chains

- Women’s Empowerment: Programs specifically targeting female farmers and workers

While progress has been made, independent assessments show that the industry still has significant work ahead to achieve these goals fully.

🔮 Market Outlook: What’s Next for Global Cocoa?

Short-Term Outlook (2026)

The outlook for 2026 is cautiously optimistic but comes with significant caveats:

✅ Positive Factors

- Supply Recovery: Production expected to rebound, with StoneX forecasting 287,000-tonne surplus for 2025/26

- Weather Improvement: Better rainfall patterns in West Africa supporting crop development

- Price Moderation: Prices falling to more sustainable levels ($4,000-6,000/tonne range)

- Demand Stabilization: Chocolate consumption may recover as prices moderate

- Inventory Rebuilding: Buyers restocking at lower price levels, supporting market activity

⚠️ Risk Factors

- Weather Dependence: Forecasts assume normal conditions; any adverse weather could reverse surplus to deficit

- Price Volatility: Low liquidity and depleted stocks mean market remains prone to sharp swings

- Structural Issues: Aging trees, diseases, and climate challenges persist

- EUDR Disruption: Compliance challenges could disrupt supply chains

- Demand Uncertainty: Economic headwinds could suppress chocolate consumption

Medium-Term Trends (2026-2030)

Looking beyond 2026, several structural trends will shape the cocoa market:

- Geographic Diversification: Gradual shift away from total West African dependence toward greater production in Latin America, other African countries, and potentially new origins. This reduces concentration risk but requires infrastructure development.

- Premium Segment Growth: Continued expansion of fine-flavor cocoa, single-origin chocolate, bean-to-bar craft chocolate, and premium products. Consumers increasingly willing to pay more for quality, sustainability, and transparency.

- Technology Integration: Digital tools for farm management, blockchain traceability, satellite monitoring for deforestation, and AI-powered disease detection becoming standard.

- Sustainability as Baseline: What are today’s “premium” sustainability practices (full traceability, deforestation-free, living wages) will become minimum market entry requirements.

- Consolidation: Market consolidation among processors and traders as smaller players struggle with compliance costs and volatility. Farmers may need to organize into cooperatives for market access.

- Alternative Proteins and Cocoa-Free Chocolate: Emerging technologies producing chocolate alternatives from fermented ingredients that don’t require cocoa. While still nascent, could become relevant if cocoa supply constraints persist.

- Climate Adaptation: Investment in drought-resistant varieties, agroforestry systems, and potentially shifting cultivation to new geographic areas as traditional zones become less suitable.

Long-Term Challenges (Beyond 2030)

The cocoa industry faces existential questions about long-term viability:

🌡️ The Climate Question

Research suggests that by 2050, many current cocoa-growing regions may become unsuitable for cultivation due to climate change. Temperature increases, changing rainfall patterns, and extreme weather could force the industry to relocate production to new areas—a massive undertaking requiring:

- Identification of new suitable regions (possibly higher elevations, different latitudes)

- Massive investment in new infrastructure, processing facilities, and logistics

- Training new farmer populations

- Transition support for current producing regions whose economies depend on cocoa

- Development of climate-resilient cocoa varieties

Without proactive adaptation, the industry could face chronic shortages and prices that make chocolate a luxury item accessible only to wealthy consumers.

Opportunities for Stakeholders

Despite challenges, the cocoa industry presents significant opportunities for various stakeholders:

| Stakeholder | Opportunities |

|---|---|

| Farmers | Higher prices (if sustained), premium payments for sustainability certifications, income diversification through agroforestry, access to better inputs and training, direct-trade relationships bypassing middlemen |

| Producing Countries | Greater value capture through local processing, leadership on sustainability standards (ARS-1000 model), export earnings from higher prices, attracting investment in processing infrastructure |

| Chocolate Manufacturers | Product differentiation through sustainability, premium positioning with single-origin and fine-flavor cocoa, transparent supply chains as marketing tool, innovation in sustainable packaging and formulations |

| Processors/Traders | Value-added services (traceability systems, farmer training, sustainability programs), vertical integration opportunities, technology solutions for transparency, premium pricing for certified sustainable cocoa |

| Technology Companies | Blockchain and digital traceability platforms, satellite monitoring services, farm management apps, climate modeling and forecasting tools, alternative protein development |

| Investors | ESG investment opportunities in sustainable agriculture, venture capital in agtech and cocoa alternatives, bonds supporting smallholder development, long-term commodity positions |

| Consumers | Greater transparency and choice, ability to support ethical production through purchasing, access to diverse flavor profiles from different origins, connection to farmer stories |

📝 Conclusion

The global cocoa market in 2026 stands at a critical juncture. After experiencing the most severe supply crisis in recent memory—with prices reaching unprecedented heights above $12,000 per tonne—the market is transitioning toward a more balanced but structurally different reality.

The dramatic price correction from over $12,000 to around $4,000 per tonne reflects improving supply prospects, particularly from favorable weather in West Africa and expanding production in Latin America. Projections for surpluses in 2025/26 and 2026/27 mark a reversal from the deficits that plagued previous seasons. Yet this recovery is fragile, built on weather assumptions that could change quickly and demand destruction that may not be sustainable.

🎯 Key Takeaways for 2026

- Prices Stabilizing Higher: While down from extreme peaks, prices are expected to remain structurally above historical norms ($6,000/tonne medium-term forecast vs. <$3,000 in 2010s), reflecting persistent supply-side challenges and increased sustainability costs.

- Supply Rebalancing: Shift from severe deficit (489,000 tonnes in 2023/24) to modest surplus (49,000 tonnes in 2024/25; 287,000 tonnes projected for 2025/26) demonstrates market’s self-correcting mechanisms but highlights weather dependency.

- Geographic Diversification: Gradual transition away from total West African dominance toward more balanced global production, with Latin America (especially Ecuador) playing increasing role. This reduces concentration risk but requires time and investment.

- Sustainability Imperative: EUDR compliance, traceability requirements, and ethical sourcing are transforming from “nice-to-have” to “must-have” for market access. The African Region Standard (ARS-1000) demonstrates producer countries taking leadership.

- Structural Challenges Persist: Climate volatility, aging trees, crop diseases, farmer poverty, and deforestation remain unresolved. These long-term issues require sustained investment and industry cooperation.

- Volatility Continues: Low global stockpiles, reduced market liquidity, weather uncertainty, and geopolitical risks mean price volatility will remain elevated even as overall levels moderate.

- Innovation Opportunity: Technology (blockchain, satellite monitoring, climate-resilient varieties), sustainable farming practices, and alternative products offer paths forward for an industry facing existential climate challenges.

For industry stakeholders—from smallholder farmers in West Africa to multinational chocolate companies to consumers worldwide—2026 represents both challenge and opportunity. The cocoa market must navigate immediate price and supply dynamics while simultaneously addressing fundamental structural issues that will determine the industry’s viability over coming decades.

The path forward requires collaboration across the supply chain: farmers need support to improve productivity and livelihoods; producing countries need infrastructure investment and fair value capture; processors and manufacturers need stable, traceable supply; and consumers need to understand that sustainable chocolate carries real costs reflected in prices.

As climate change accelerates and sustainability expectations rise, the cocoa industry cannot rely on business-as-usual approaches. The market of 2026—with its price volatility, regulatory pressures, and supply shifts—is forcing adaptation and innovation. Whether the industry successfully navigates this transition will determine not just near-term profitability but whether future generations can continue enjoying one of humanity’s most beloved foods: chocolate.

Appendix:

Understanding Global Cocoa Markets

This analysis provides comprehensive insights into the cocoa market’s current state and future trajectory. For businesses in chocolate manufacturing, trading, or food service, staying informed about these trends is essential for strategic planning and risk management.

Last Updated: February 2026 | Data sources: ICCO, major commodity analysts, industry reports