Cocoa beans, also known as cacao beans, are the essential foundation of the chocolate industry. These prized beans are harvested from the cacao tree, a tropical plant native to the rainforests of Western Africa, Central, and South America. Over thousands of years, the cultivation of cocoa has spread across the globe, but the beans remain at the heart of every chocolate product. The journey from cacao pod to chocolate bar involves careful harvesting, fermentation, and drying, all of which are crucial for developing the rich flavors and aromas that chocolate lovers crave. Today, the demand for cocoa beans is higher than ever, driven by the worldwide love for chocolate and the growing popularity of cocoa-based products, from cocoa powder to luxurious cocoa butter. Whether you call them cocoa or cacao, these beans are the starting point for all things chocolate, making them a vital agricultural commodity for many countries.

Global Cocoa Production and Leading Producing Countries

The world’s top cocoa bean-producing countries are primarily found in West Africa, South America, and Southeast Asia, regions where the climate and soil are ideal for cultivating cacao trees. These countries are responsible for the majority of the global cocoa supply, and each region imparts unique characteristics to its beans. For example, some countries are known for producing cocoa beans with bright, fruity, and floral notes, while others are celebrated for beans with deep, robust, or even slightly acidic flavors. The origin of the beans plays a significant role in the taste and quality of the final chocolate product, making it a key consideration for chocolate makers and consumers alike. The trade of cocoa beans is a major economic driver for many producing countries, with exports providing vital income and supporting millions of livelihoods. As the demand for chocolate and other cocoa products continues to grow, the global cocoa market remains dynamic, with prices and trade flows influenced by factors such as weather, crop yields, and changing consumer preferences.

Top Cocoa Bean-Producing Countries: Taste, Origin, and Trade

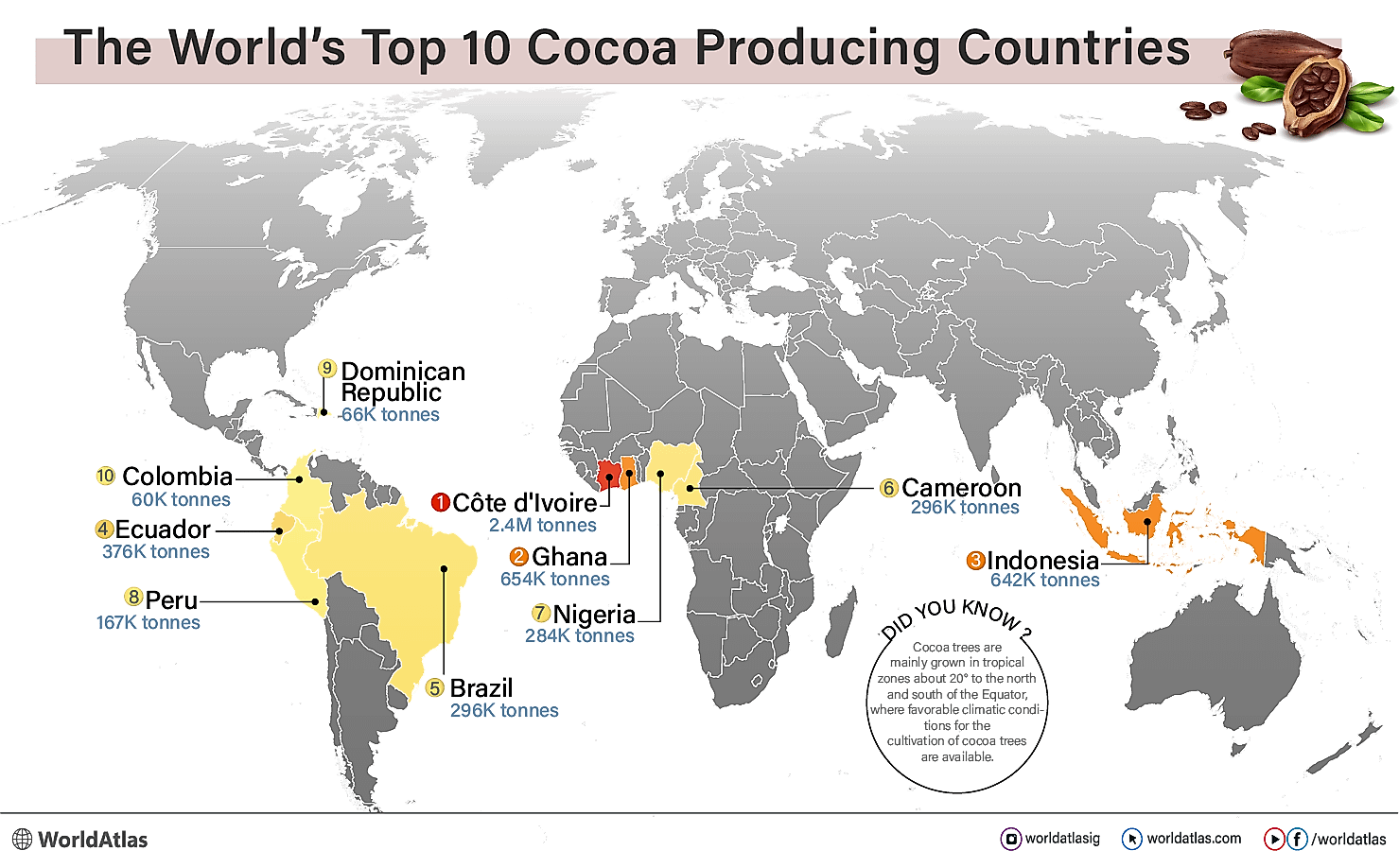

Cocoa is cultivated in tropical regions around the world, but a few countries dominate the global supply. In cocoa year 2022/23, Côte d’Ivoire led production at roughly 2.24 million (about one-third of global output), followed by Ghana at ~654,000 (tonnesicco.org).

Indonesia (~641,741 t) and Ecuador (~375,719 t) are the leading producers in Asia and Latin America, respectively. Other major producers include Brazil (~296,145 t), Cameroon (~295,819 t), Nigeria (~284,232 t), Peru (~166,709 t), and the Dominican Republic (~65,930 t) (worldatlas.com).

Together, Côte d’Ivoire and Ghana account for roughly 60% of the world’s cocoa (supplyreuters.com).

(The table below summarizes the top-producing countries and their 2023 production.)

| Country | 2023 Production (tonnes)worldatlas.com | Approx. Share of World Production |

| Côte d’Ivoire | 2,377,442 | ~34% |

| Ghana | 653,700 | ~9% |

| Indonesia | 641,741 | ~9% |

| Ecuador | 375,719 | ~5% |

| Brazil | 296,145 | ~4% |

| Cameroon | 295,819 | ~4% |

| Nigeria | 284,232 | ~4% |

| Peru | 166,709 | ~2% |

| Dominican Republic | 65,930 | ~1% |

| Colombia | 59,831 | ~1% |

| Papua New Guinea | 43,200 (estimate) | ~0.6% |

| Others | (including DRC 35,000; Uganda 35,000; India 30,000; etc.) | remainder |

🍫 Why is the Origin of Cocoa Beans Crucial for Chocolate Manufacturers?

Cocoa is not just a commodity; it’s a cultural and agricultural fingerprint of the land it comes from. The soil, climate, farming practices, and even the way beans are fermented and dried all influence the taste and quality of the cocoa. Understanding the characteristics, types, nutritional content, and production statistics of cocoa beans from different countries is crucial for buyers, chocolatiers, and enthusiasts alike. Each major cocoa-producing country has its own set of growing regions, bean varieties, and processing practices: That’s why buyers today look beyond quantity—they’re interested in origin, flavor notes, certification, and sustainability.

Let’s break down the major cocoa-producing countries and what makes their beans stand out.

🇨🇮 Côte d’Ivoire (Ivory Coast)—The World’s Largest Cocoa Producer.

Cocoa is grown mainly in the southwest (Bas-Sassandra, San Pedro, Haut-Sassandra) under hot, humid conditions. Ivory Coast beans are almost entirely bulk Forastero hybrids (often West African Amelonado type). Fermentation and drying are done on-farm (heap or box fermentation for ~5–7 days).

The beans tend to have a robust, deeply chocolatey flavor but are not usually classified as fine “aroma” cocoa.

Exports in 2022/23 were ~1.44 million tonnes, with Côte d’Ivoire supplying roughly one-third of global exports. (Recent poor weather caused a sharp drop to 1.76 Mt in 2023/24, down ~24% from 2.3 Mt in 2022/23 (apps.fas.usda.gov.)

-

Global Rank: 1st

-

Annual Production: Approximately 2.2 million metric tons

-

Exports: ~1.5 million tons

-

Cocoa Type: Mostly Forastero

-

Types of Cocoa: Primarily Forastero variety.

-

Global Share: Around 40.9% of global cocoa production (Current Affairs Adda247)

Cocoa Characteristics: Côte d’Ivoire predominantly cultivates Forastero cocoa beans, known for their robust (strong, bitter) flavor and high yield. These beans are often used in mass-produced chocolates due to their consistency and strong cocoa taste.

Nutritional Content: Forastero beans are rich in theobromine and caffeine, contributing to their stimulant properties. They also contain significant amounts of flavonoids, which have antioxidant effects.

Market Insights: Despite being the largest producer, Côte d’Ivoire faces challenges such as deforestation and the need for sustainable farming practices. Efforts are ongoing to improve traceability and ethical sourcing.

🇬🇭 Ghana Cocoa Beans—Bold, Bitter, and Balanced (The Gold Standard)

The second-largest producer, with core regions in the Western, Central, and Ashanti regions.

Ghanaian cocoa is almost entirely Forastero (traditional Amelonado variety), well-fermented and sun-dried. Ghana is known for beans with relatively mild, sweet-fruit aromas and fine cocoa flavor (used in premium chocolates).

Cocoa production has averaged ~800,000 t in recent years but fell from 1.04 Mt (2020/21) to about 531,000 t in 2023/24 due to disease and erratic weather.

Production is now rebounding (forecast ~700,000 t for 2024/25).

Exports were ~336,000 t in 2023/24 and are expected to rise with the larger crop (apps.fas.usda.gov). Ghana’s Cocoa Board (COCOBOD) tightly controls pricing and quality through its purchasing program.

Global Rank: #2

Key Stats:

-

Second-largest producer, contributing ~12% of global cocoa .

-

Cocoa accounts for 14% of Ghana’s GDP.

-

Annual Production: ~850,000 metric tons

-

Cocoa Type: Forastero (fine flavor grade)

Characteristics:

-

Bean Type: Hybrid Forastero-Criollo blends.

-

Flavor Profile: Balanced acidity with nutty undertones.

-

Unique Fact: Ghanaian cocoa is often labeled “Premium” due to strict quality controls.

Ghanaian cocoa is often preferred for its consistent quality, rich aroma, and bold flavor. It has a slightly more refined bitterness compared to Côte d’Ivoire beans.

Nutritional Profile:

Ghanaian beans are known for high polyphenol content, which contributes to their antioxidant capacity.

Rich in potassium (2,509 mg/100 g) and fiber (30 g/100 g).

PS

Ghana was the first African country to get ISO certification for traceable cocoa, which gives buyers more confidence in quality and ethics.

🇮🇩 Indonesian Cocoa Beans – Earthy and Smoky Cocoa

The largest Asian producer, with main growing areas on Sulawesi (Tana Toraja), Sumatra, Papua and Java.

Indonesian cocoa is mostly Forastero (farmers use hybrid planting materials) and often produced by smallholders.

The beans tend to be earthy and mild, used widely in cocoa butter and powder. Indonesia produced about 641,741 t in 2023.

The local government and programs like Cocoa Life are working to improve fermentation consistency. Exports are comparatively small (Indonesia is also a big cocoa grinder) but growing—world supply forecasts see Indonesian output rising by ~30% to ~836,000 t by 2026 (worldatlas.com) as productivity improves.

Global Rank: #3

Annual Production: 641,741 tonnes (2023).

-

Cocoa Type: Mostly Forastero, some Trinitario

Key Stats:

-

Dominates Southeast Asia’s cocoa market.

-

Exports hit $47 million in 2023.

Characteristics:

-

Bean Type: Forastero, with some Trinitario in Sulawesi.

-

Flavor Profile: Mild and fruity, often used in blends.

-

Processing: Fermentation practices vary, leading to inconsistent quality.

Indonesian beans are earthy, woody, and often carry a smoky aftertaste due to traditional drying methods over open fires.

Nutritional Profile:

Lower fat content (~48%) but high in copper (3.8 mg/100 g), crucial for antioxidant enzymes. It is also fiber and natural caffeine.

Unique Insight:

Indonesia supplies beans, especially to Asian markets, and is growing in interest due to organic and rainforest-certified production methods. Production could reach 836,000 tonnes by 2026 with improved farming techniques.

🇪🇨 Ecuador Cocoa Beans – Floral Virtuoso (Fine-Flavor Cocoa)

Renowned for its fine “Nacional” cocoa variety. Production (~375,719 t in 2023) comes from the Andean foothills and the Amazon basin. Ecuador’s beans (heirloom Nacional and Trinitario hybrids) yield floral, fruity, and complex chocolate flavors, making up ~65% of the world’s fine-aroma cocoa (worldcocoaworldatlas.com).

Beans are fully fermented in wooden boxes (5–7 days) and dried on cement or mats. Ecuador exports most of its crop; about 85% of production is exported as nibs, powder, and liquor.

Global Rank: #4

Production: 375,719 tonnes (2023).

Key Stats:

-

Holds 65% of the global fine cocoa market .

-

Exports valued at $192 million (2023) .

-

Cocoa Type: Nacional (Arriba), Trinitario

Characteristics:

-

Bean Type: Nacional Criollo, famed for floral and spicy notes.

-

Flavor Profile: Complex, aromatic, and sought-after by craft chocolatiers.

-

Unique Fact: Grown in the Andes and Amazon, benefiting from volcanic soil.

Ecuador is famous for its floral, fruity cocoa beans. Arriba Nacional beans are often used in artisanal and premium chocolates.

Nutritional Profile:

Higher in natural cocoa butter, giving the chocolate a smoother, creamier texture.

Higher antioxidants (flavanols) due to minimal processing.

Value Proposition:

Ecuador exports one of the highest proportions of fine-flavor cocoa globally, making it a darling of specialty chocolatiers. Over 35,000 farms practice agroforestry, blending cocoa with shade trees .

🇧🇷 Brazilian Cocoa Beans—(Complex and Fruity Cocoa)

Once the largest producer, Brazil now grows ~296,145 t (2023) (worldatlas.com), mainly in Bahia and Pará states.

Brazilian cocoa comprises Forastero and Trinitario, with many farms moving toward organic and sustainable practices. Brazil is noted for high-quality beans (winning “Cocoa of Excellence” awards), but overall output has declined since the 1980s due to disease and replanting.

Still, Brazil exports ~50,000 t/yr, and domestic grinding is growing.

Global Rank: #5

Production: 296,145 tonnes (2023).

Key Stats:

-

Won the 2023 Cocoa of Excellence Award for sustainable practices.

-

Exports: $2 million (2023).

-

Cocoa Type: Trinitario, Forastero, and Amazonian hybrids.

-

Flavor Profile: Fruity with hints of caramel, ideal for dark chocolate.

Characteristics of Brazilian Cocoa Beans:

Brazilian cocoa has wine-like acidity, fruity notes, and a slightly nutty base. Flavor varies by region—Bahia beans are different from those in the Amazon.

Nutritional Profile:

High in selenium (14.3 µg/100 g), supporting immune health.

Beans from Brazil are high in magnesium and flavonoids, contributing to heart and brain health.

Market Note:

Brazilian cocoa is gaining attention for its traceability, organic options, and sustainability certifications.

Recovering from a 1980s production crash due to disease, but aiming for 400,000 tons by 2030.

🇨🇲 Cameroon Cocoa Beans—Aromatic and Slightly Acidic

West Africa’s third-largest grower (295,819 t in 2023) [worldatlas.com]. Key regions include Littoral, South, Central, and Southwest regions.

Cameroon cocoa has traditionally been lower-grade, but production reforms have raised quality (many beans are now Grade I).

Cameroonian beans are mostly Forastero, with a balanced flavor profile. Much of Cameroon’s cocoa is semi-processed domestically (butter, powder) and regionally traded. Recent industry roadmaps emphasize sustainability and farm efficiency.

Global Rank: #6

Production: 295,819 tonnes (2023) .

Key Stats:

-

40% of the output is Grade I quality.

-

Focuses on domestic processing over exports.

Cocoa Characteristics:

-

Bean Type: Forastero, with improved fermentation techniques.

-

Flavor Profile: Deep cocoa bitterness, perfect for baking.

Cameroon’s cocoa is aromatic, with mild acidity and light bitterness, well-suited for blending.

Nutrition: High phosphorus (734 mg/100 g) for bone health.

Balanced in flavonoids and alkaloids, ideal for health-conscious formulations.

Market Insight:

Mostly exported in bulk, but a growing bean-to-bar community is rising in Cameroon.

🇳🇬 Nigeria Cocoa Beans—Cocoa with Depth and Demand

Nigeria’s southwestern states (Ondo, Cross River, Edo) grow ~284,232 t (2023) [worldatlas.com].

Nigerian cocoa is mainly Upper Amazonas Forastero: large beans with a sweet, fruity character. Production rebounded ~10% in 2024 on good weather.

Nigeria’s export volumes (~700 million USD value in 2023) and investment in the sector are rising. Challenges include outgrower funding, farm labor, and the expansion of illegal farms into protected forests.

Global Rank: #7

Production: 284,232 tonnes (2023).

Key Stats:

-

10% production increase in 2024 due to favorable weather .

-

Exports: $700 million (2023).

-

Bean Type: Amelonado Forastero.

-

Flavor Profile: Earthy with a smoky finish.

Characteristics:

Nigerian cocoa is known for its deep, rich color, bold flavor, and well-fermented aroma. It’s very popular among European buyers.

Nutritional Profile:

Iron-rich (13.86 mg/100 g), combating anemia.

Contains high theobromine levels, which support mood and alertness.

Trade Advantage:

Nigeria has robust bulk supply chains and an emerging interest in single-origin sourcing.

Peruvian Cocoa Beans (Peru)

A long-established cocoa region, with small farms in the Amazon and Andes yielding Criollo and Trinitario (and CCN-51 hybrids).

Peru produced ~166,709 t in 2023 (worldatlas.com) and is a major exporter of organic and fine cocoa. Peruvian beans offer earthy, fruity, and floral notes, and the industry focuses on specialty markets.

Organic certification and fair-trade practices are common. Production is forecast to grow by ~2–5% annually through 2030, as recorded by World Atlas.

Global Rank: #8

Production: 166,708 tonnes (2023) .

Key Stats:

-

Home to heirloom varieties like Theobroma cocoa .

-

Exports: $225 million (2023) .

Cocoa Characteristics:

-

Bean Type: Criollo and Trinitario.

-

Flavor Profile: Fruity (mango, citrus) and earthy notes.

Nutrition: High manganese (3.8mg/100g) for metabolism support .

Heritage: Indigenous communities have cultivated cocoa since 1900 BC.

Dominican Republic Cocoa Beans

A leader in organic and premium cocoa. In 2023 it produced ~65,930 t, much smaller volumes but high value (export revenue ~$192 M).

Dominican cocoa (mostly Trinitario grown under shade trees) is prized for smooth, aromatic flavors. The government encourages smallholder cooperatives and organic farming.

Colombian Cocoa Beans

Emerging producer (59,831 t in 2023). Colombian cocoa (Andean Criollo and Trinitario) saw a ~36% rise from 2021.

Key markets include the US. Quality is improving via traceability and producer support programs. Colombia’s cocoa industry is smaller but poised for growth with continued investment.

Each country’s cocoa also has typical flavor profiles and bean varieties, influenced by terroir. For example, Ghanaian beans often have sweet-acidic notes with low bitterness; Ivorian beans are strong and rich but less fruity; Ecuadorean Nacional beans are floral and complex; and Indonesian beans can be earthy or nutty. Fermentation and drying practices vary (e.g. box vs. heap fermentation, sun-drying) and strongly affect final flavor.

Nutritional Profile of Cocoa Beans

Cocoa beans are nutrient-dense. Cocoa nibs (dried fermented beans) are roughly half fat by weight, primarily cocoa butter (rich in stearic and oleic acids).

Protein and fiber each contribute roughly 10–15%.

Cocoa contains significant polyphenols (antioxidant flavonoids like catechins and procyanidins) in the range of ~12–18% (cacaoweb.net) of the bean’s dry weight, giving health benefits and bitterness.

Theobromine, a mild stimulant, is the principal alkaloid (~1.5–2.5% of bean weight) (ncbi.nlm.nih.gov).

Caffeine is present only in trace amounts (typically <0.5%).

Key nutritional points for buyers: the fat content (cocoa butter) is typically ~50–57% (important for butter yield), and antioxidant phenolic content is high compared to many foods.

Moisture in properly dried beans is usually 6–7%, preventing mold growth.

Table: Approximate composition of dry cocoa beans (nibs)

| Component | Typical Range (dry weight) |

| Fat (cocoa butter) | ~50–57% |

| Protein | ~10–15% (by difference) |

| Fiber | ~10–15% |

| Carbohydrates (incl. sugars) | ~10–15% |

| Polyphenols (flavonoids) | ~12–18% |

| Theobromine | ~1.5–3% |

| Caffeine | <0.5% (trace) |

| Ash (minerals) | ~2–6% |

Nutritional Content of Raw Cocoa Beans

Cocoa beans are nutrient-dense, but their profiles vary slightly by origin:

|

Nutrient

|

Average per 100g

|

Health Benefits

|

|

Magnesium

|

476mg

|

Supports muscle & nerve function

|

|

Iron

|

13.86mg

|

Boosts blood health

|

|

Flavonoids

|

High

|

Lowers blood pressure

|

|

Fiber

|

30g

|

Aids digestion

|

|

Theobromine

|

1.2g

|

Mild stimulant, improves mood

|

Single-Origin Cocoa and Terroir

“Single-origin” cocoa refers to beans sourced from a specific country, region, or even estate. This practice highlights how terroir—the local soil, climate, and growing conditions—shapes bean flavor.

As one chocolatier notes, single-origin sourcing means cacao from one place, so varietals and environment give “distinct” flavors.

For instance, volcanic soils in Madagascar impart bright, fruity notes; rich Andean soils in Ecuador yield complex floral undertones. Altitude and rainfall patterns further influence acidity and tannin levels in beans.

Thus, single-origin beans can command premium prices for their unique sensory profiles. Buyers who value flavor complexity often seek beans from specific origins (e.g., Ghana “forest” beans, Venezuelan Criollo, or Peruvian Arriba Nacional) to utilize in fine chocolates or flavor-driven products.

The Importance of Single-Origin Cocoa

Single-origin cocoa refers to beans sourced from a specific region or country, offering unique flavor profiles reflective of the local terroir. This specificity allows chocolatiers to create distinct products and provides consumers with traceability and a connection to the source. Single-origin chocolates are often associated with higher quality and ethical sourcing practices.

Regional Industry Differences in Cocoa Production

The cocoa sector varies by region. West Africa (Ivory Coast, Ghana, Nigeria, Cameroon, etc.) produces about 70% of the world’s cocoa, mostly bulk Forastero varieties.

West African supply is typically lower-priced, large-scale, and coordinated through national boards or coop buyers. Aging trees, low soil fertility, and pests (e.g., swollen shoot virus) have recently depressed yields in Ghana and Ivory Coast. Governments often set fixed farmgate prices and require beans meet quality standards (uniform fermentation, low moisture). Infrastructure and small farm sizes limit mechanization.

By contrast, Latin America (Ecuador, Peru, Brazil, Central America) produces more fine-aroma and organic cocoa. Many farms focus on high-quality Criollo/Trinitario beans. Production is a smaller share (around 20% of world) but often has better traceability and a higher per-tonne value.

For example, Ecuador supplies most of the world’s fine cocoa, and Central American countries (like the Dominican Republic) emphasize organic, fair-trade crops.

Processing facilities in L.America may handle their own beans or export nibs and liquor, but a larger proportion of cocoa stays within these countries compared to West Africa.

Southeast Asia (Indonesia, Papua New Guinea, Malaysia) is smaller still (~5% of global supply). Many Asian countries began commercial cocoa cultivation in the 20th century. Beans are mostly Forastero (some Trinitario in PNG).

While overall quality is improving (Indonesia’s Cocoa Life program, Philippine organic farms), Asia’s output is dominated by Indonesia. Processing (especially in Malaysia and Singapore) is significant: for instance, Malaysia imports African beans for grinding.

Overall, chocolate manufacturers blend beans from multiple origins to achieve consistency. However, demand for single-origin and higher-quality beans is growing, especially in Europe, North America, and Asia’s specialty markets.

Evaluating Cocoa Bean Quality

Buyers and traders assess raw cocoa quality using several parameters:

-

Moisture Content:

Ideal beans have about 6–7% moisture. Beans dried to ~7% moisture resist mold and are safe to store. Moisture meters are used to check that beans are fully dried (above ~7.5% is considered too wet).

-

Fermentation Level:

Proper fermentation is crucial for flavor. The cut test (splitting a sample of beans) reveals interior color. Well-fermented beans show a brown cotyledon; unfermented beans remain purplish and taste grassy. Beans are usually fermented 5–7 days in wooden boxes or heaps. Buyers inspect cut-test results: many brown beans with few moldy or slaty (grey) ones indicates good

-

Defects/Mold:

High-quality beans are virtually free of mold, germinated kernels, flat or slaty beans, and infestation. Mold or rodent infestation introduces off-flavors and health risks (mycotoxins).

-

Bean Count and Size:

“Bean count” (number of beans per 100 g) indicates average bean size – lower count = larger beans. Uniform bean size allows even roasting and processing. Buyers prefer lots where beans are similar in size and not overly broken (≥90% whole beans is typical). Table 1 of the International Cocoa Organization’s standards specifies bean count ranges for classification.

-

Fat (Cocoa Butter) Content:

While not directly visible, cocoa butter percentage can be lab-tested. Premium beans often contain 50–55% butter. A high fat content indicates fully mature beans; immature beans have lower fat and generate less butter yield.

-

Bean Count:

A higher bean count (e.g. ~100 beans per 100 g) means smaller beans, while a lower count (~80) means larger beans. Buyers use bean count and size uniformity as quick quality proxies (larger beans are generally more expensive).

Quality certificates and lab analyses complement physical inspection. Ultimately, flavor and contaminants are assessed through sensory analysis and chemical tests. Strict standards (ISO 2451 and national grades) require fermented, dried beans “reasonably free” of defects, with moisture ≤7.5% and minimal infestation or off-odors.

Sustainability Challenges in the Cocoa Supply Chain

The cocoa industry faces serious sustainability issues, especially in West Africa. Historically, massive areas of forest in Ghana and Côte d’Ivoire were cleared for cocoa. From 2001–2015, cocoa cultivation was linked to the loss of one-third of Ghana’s forests and one-quarter of Côte d’Ivoire’s.

Recent analyses estimate that ~94% of Ghana’s deforestation and ~80% of Côte d’Ivoire’s was driven by cocoa expansion. While initiatives like the Cocoa & Forests Initiative (CFI) aim to halt deforestation and restore forest reserves, enforcement remains challenging. Buyers sourcing West African beans increasingly demand traceability and zero-deforestation commitments. (For example, companies are mapping supply chains and using WRI’s Cocoa Deforestation Risk Assessment to target conservation)

Child labor and low farm incomes are also critical issues. In Ghana and Ivory Coast, the poverty line is widely reported at < $2/day for cocoa farmers. Low incomes drive some farmers to clear more land (and sometimes employ children) to try to boost output (reuters.com). This is so sad, and radad international is working hard to put an end to this exploitation.

Indeed, one analysis notes that low income and lack of alternative livelihoods are primary causes of both deforestation and child labor in West Africa. Efforts by governments, NGOs and industry (e.g. higher prices via Ghana-Ivory Living Income Differential, child-protection programs) seek to address these problems.

Climate change is adding stress. In 2023–24, extreme weather in West Africa (unusual heavy rains, black pod disease, then drought) caused a sharp production shortfall. (icco.org).

This underscores that aging tree stock and erratic climates may be a structural constraint: Ghana’s output has fallen since its 2020/21 peak (down ~50% by 2023/24) due to virus, poor rains, and falling farm investments. Future viability will depend on farm renovation, shade management, and sustainable practices.

As a result of these challenges, buyers are placing more emphasis on sustainability certification and partnerships. Schemes like Fair Trade, Rainforest Alliance, and UTZ (biodiversity criteria) are more common. Large chocolate companies now report origin transparency and have joined initiatives to improve farmer livelihoods and forest protection. Nonetheless, cocoa remains vulnerable: the same factors affecting supply (pests, weather, price volatility) continue to pose ethical and business risks.

Global Cocoa Market Trends

In recent years, global cocoa supply and demand have been tight. After surpluses in the 2010s, three consecutive deficit years in 2020/21–2022/23 pushed stock-to-grindings to very low levels (supermarketperimeter.com).

In 2022/23 the world produced about 4.49 Mt and demand (grindings) was about 4.885 Mt, leaving a shortage. Bean prices thus climbed: e.g. in early 2024 futures exceeded $10,000 per tonne on ICE Londonreuters.com (roughly triple the long-term average).

However, forecasts for 2024/25 signaled a turnaround. The International Cocoa Organization (ICCO) projected a global production rise of 7.8% to ~4.84 Mt—led by better yields in Côte d’Ivoire (~1.85 Mt forecast) and Ghana (~600k). At the same time, world grindings were expected to slip by ~4.8% to 4.65 Mt as demand cooled

This shift to a mild surplus of ~0.14 Mt (2024/25) caused futures to retreat from their peaks peaks. In summary, the market is cyclical: price spikes follow shortages, which then dampen demand or boost planting.

📈 Global Cocoa Trade Snapshot (2024 Est.):

| Country | Production (MT) | Global Share (%) | Major Export Markets |

| Côte d’Ivoire | 2,000,000 | 40% | EU, US, Malaysia |

| Ghana | 850,000 | 17% | EU, Japan, US |

| Indonesia | 650,000 | 13% | Malaysia, Singapore, EU |

| Ecuador | 330,000 | 7% | US, EU, South America |

| Nigeria | 280,000 | 5.50% | EU, Asia |

| Cameroon | 275,000 | 5.50% | EU, Middle East |

| Brazil | 270,000 | 5% | Local, US, EU |

Long-term, cocoa demand is driven by global chocolate and confectionery growth. Emerging markets (China, India) are expanding their cocoa consumption, but developed markets (Europe, USA, Japan) still account for ~70% of grindings. Major importers of cocoa beans are concentrated in the EU and North America.

For example, the European Union is the world’s largest importer, sourcing roughly 40% of its cocoa from Côte d’Ivoire and 12% fromd 12% from Ghana (trendeconomy.com). The United States imported about 269,000 t of raw cocoa beans in 2023, mostly from Côte d’Ivoire, Ecuador, and Ghana. Other important importers include the Netherlands (major grinder), Germany, Belgium, Malaysia, and Japan.

Price volatility remains a concern. In late 2024, extreme weather in West Africa led to forecasts of a large shortfall (~374,000 t deficit for 2023/24), keeping prices high. Conversely, record harvests or demand dips can depress prices.

Forward-looking buyers watch reports (ICCO Quarterly Bulletins, national forecasts) closely. Currently, analysts note that very high spot prices may slow chocolate demand growth and encourage stock-building, which can temper price rises.

Table: Global Cocoa Supply and Demand (2023/24)

| Category | Volume (million tonnes)icco.orgsupermarketperimeter.com | Year |

| World Production | 4.382 | 23/24 (Oct–Sep) |

| World Grindings | 4.816 | 23/24 (calendar) |

| Ending Stocks/Surplus | -0.434 (deficit) | 23/24 |

| World Production | 4.84 | 24/25 (forecast) |

| World Grindings | 4.65 | 24/25 (forecast) |

| Stocks/Surplus | +0.142 (surplus) | 24/25 |

This image is taken from ICCo website, and I have no copyright claims to it

Reliable Cocoa Beans Supplier | Radad International

In this challenging supply environment, sourcing high-quality, traceable cocoa is critical. Radad International is a seasoned bulk cocoa supplier specializing in West African beans (especially from Ghana, Nigeria, and Côte d’Ivoire).

With established partnerships on the ground, Radad offers fully traceable shipments, vetted at origin to meet rigorous quality standards (uniform fermentation, moisture, and size). By working directly with cooperatives and government-licensed exporters, Radad ensures consistency in flavor and butter content.

Importantly, Radad emphasizes ethical sourcing: beans are procured from audited farms that comply with labor laws and sustainability initiatives. Buyers seeking a stable supply chain can leverage Radad’s expertise to navigate quality specifications (e.g., butterfat %, bean count) and secure timely shipments.

In short, Radad International positions itself as a trusted partner for bulk cocoa procurement, bridging the gap between growers and global manufacturers with a commitment to quality and responsible practices.

FAQS

🍃 What is Single-Origin Cocoa Sourcing, and Why Does It Matter?

Single-origin cocoa means beans come from a specific region or even farm, offering traceability and unique taste profiles. Think of it like wine—beans from a volcanic region in Ecuador will taste different from rainforest cocoa in Nigeria.

Why buyers love it:

-

Unique flavor for premium chocolates

-

Ethical sourcing and transparency

-

Better quality control

-

Often tied to fair trade and organic practices

How Should Buyers Choose Cocoa Beans?

When sourcing cocoa beans in bulk, consider:

-

Origin: Affects flavor, oil content, and price

-

Cocoa Variety: Forastero (bulk), Trinitario (balanced), Criollo (fine flavor)

-

Certifications: Organic, Fair Trade, UTZ, Rainforest Alliance

-

Fermentation: Impacts taste and aroma

-

Moisture & Mould Levels: Should meet export standards

-

Fat Content: Higher fat = richer chocolate

Why Do People Prefer Sourcing Single-Origin Cocoa

Single-origin cocoa refers to beans sourced from one region, estate, or even a single farm. Unlike blended cocoa, it showcases terroir—the unique soil, climate, and processing methods of its origin. Here’s why it’s trending:

-

Flavor Complexity:

-

Mexican cocoa offers floral notes, while Tanzanian beans are intensely bitter .

-

Ecuador’s Nacional variety is prized for its spicy undertones .

-

-

Transparency:

-

75% of consumers perceive single-origin chocolate as premium and sustainable .

-

Brands like Tony’s Chocolonely highlight farmer partnerships and ethical practices .

-

-

Market Value:

-

Single-origin bars sell for 2–3x the price of mass-market chocolate .

-

Challenges:

-

Generalization: Labeling beans by country (e.g., “Ghana bar”) can oversimplify regional diversity.

-

Fraud Risk: Some exporters blend cheap beans while marketing as single-origin .

Which country produces the most cocoa?

A: Côte d’Ivoire dominates with 2.38 million tonnes annually .

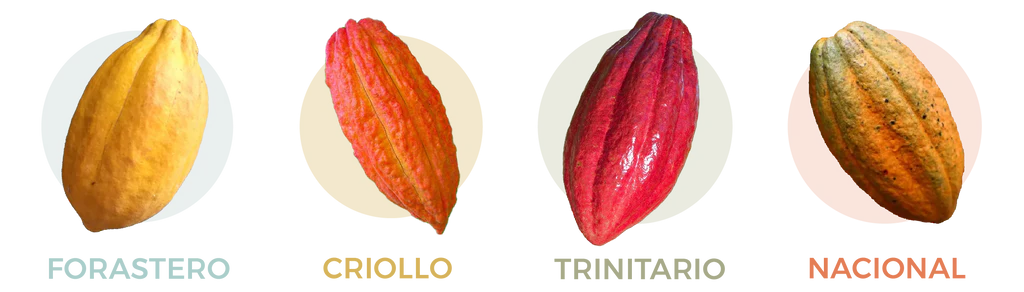

What’s the difference between Criollo and Forastero beans?

A: Criollo is aromatic and rare, while Forastero is hardy and widely used .

What are the Differences in Cocoa Varieties?

-

Forastero: The most widely cultivated variety, known for its hardiness and high yield. It has a strong, classic cocoa flavor and is used in mass-market chocolate production.

-

Criollo: A rare and delicate variety, prized for its complex flavor profile. It is used in fine chocolates and commands a premium price.

-

Trinitario: A hybrid of Forastero and Criollo, combining the hardiness of the former with the flavor qualities of the latter. It is used in both premium and mass-market chocolates.

How can I verify cocoa quality?

Request lab reports for moisture, fat, and mycotoxins. Bulk cocoa bean suppliers like Radad International provide pre-shipment inspections.

Why is single-origin cocoa expensive?

It reflects unique terroir and often involves ethical premiums paid to farmers.

🌍 Looking for Bulk Cocoa Beans?

If you’re in the market for high-quality, bulk cocoa beans, RADAD International is a trusted name in global cocoa exports. With a presence in Nigeria and Dubai, RADAD supplies top-grade beans from West Africa—especially Ghana and Nigeria—to partners across Europe, the Middle East, and Asia.

Whether you’re a chocolatier, manufacturer, or distributor, RADAD ensures:

-

Strict quality control

-

Flexible volumes

-

Fair trade and traceable sourcing

To explore sourcing opportunities or request specifications, contact RADAD International directly.

Overall, understanding the nuances of each country’s cocoa, from production scale to flavor, is essential for buyers. Armed with the latest production data, quality standards, and awareness of sustainability issues, international cocoa buyers can make informed sourcing decisions and partner with suppliers like Radad to navigate the evolving cocoa market.

One Response

Great post! We are linking to this great post on our site.

Keep up the great writing.