UAE Chocolate Market 2026: Comprehensive Analysis, Growth Trends & Leading Manufacturers

Published by FUNUI DONARD | February 2026 | RADAD International

Market Overview: Size and Growth Projections

UAE Chocolate Market at a Glance (2026)

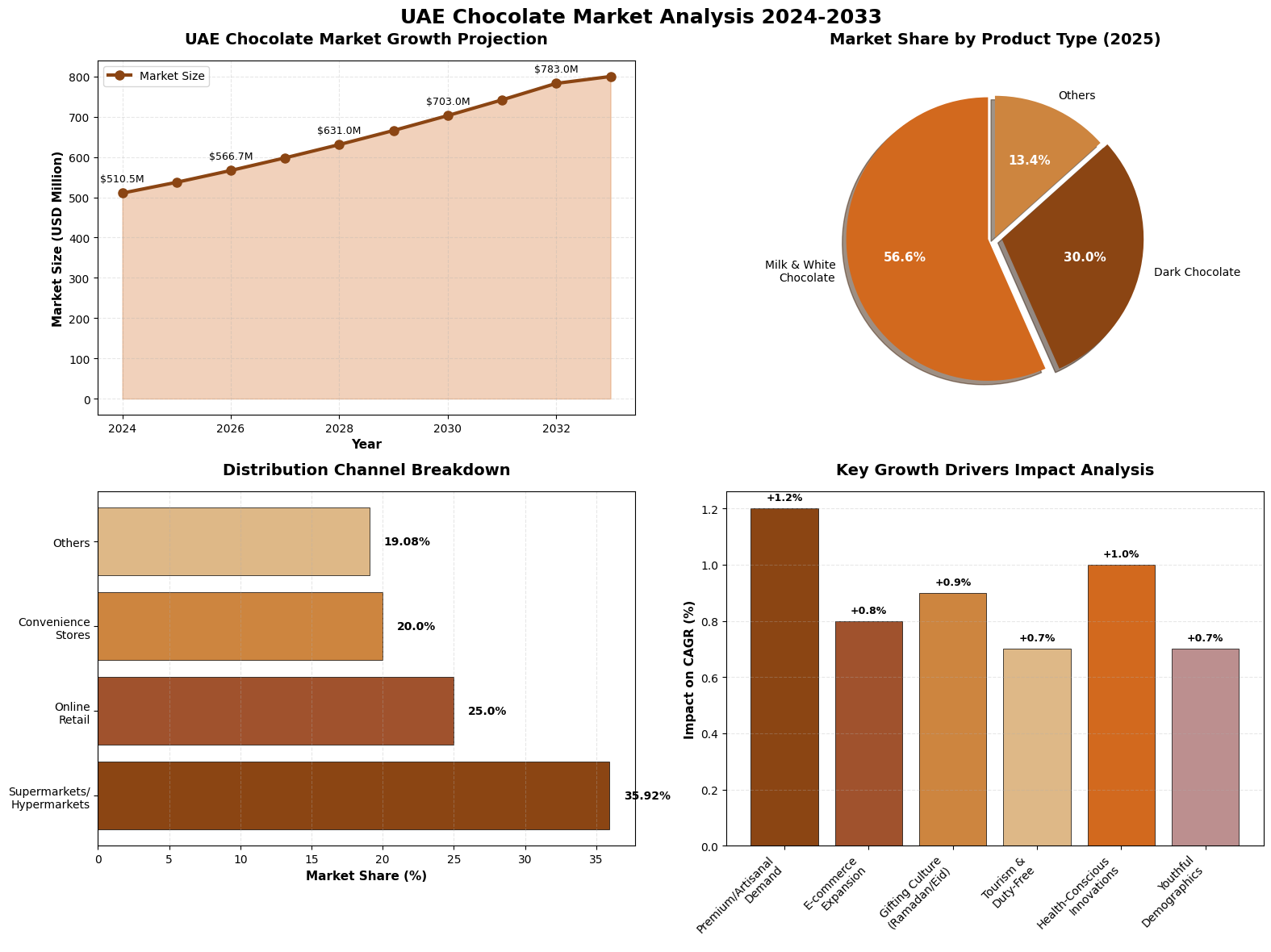

The UAE chocolate market has demonstrated remarkable resilience and consistent growth despite global economic challenges. Starting from a valuation of USD 537.30 million in 2025, the market reached USD 566.68 million in 2026 and is projected to achieve USD 739.39 million by 2031, growing at a compound annual growth rate (CAGR) of 5.47%.(DiMarket)

This steady expansion occurs even as cocoa prices nearly doubled between 2024 and 2025, highlighting the sustained demand for premium and artisanal chocolate products in the UAE. The market appears less affected by fluctuations in raw material costs, particularly in the premium segment where consumers prioritize quality and brand prestige over price considerations.

Alternative Market Projections

Different research firms provide varying estimates, reflecting different methodologies and segment focus:

- Verified Market Research: Projects the market reaching USD 2.35 billion by 2032 at a CAGR of 5.3% (includes broader chocolate-related segments)

- The Report Cube: Estimates USD 510.5 million in 2025, growing to USD 800.11 million by 2032 at a CAGR of 6.63%

- Grand View Research: Forecasts USD 814.7 million by 2030 with a CAGR of 7.7% from 2024 to 2030

Note: Variations in projections stem from differences in market segmentation, data collection methods, and inclusion of industrial vs. retail chocolate sales.

Leading Chocolate Manufacturers in the UAE

The UAE chocolate market features a dynamic competitive landscape with both international giants and distinguished local artisanal brands. The market demonstrates moderately high concentration, with major multinational corporations dominating mass-market volume while premium and gifting segments are led by specialized luxury brands.

International Chocolate Powerhouses

Mars, Incorporated

Leading mass-market player with popular brands including M&M’s, Snickers, Twix, and Milky Way. Strong presence in supermarkets, hypermarkets, and convenience stores across all seven emirates.

Ferrero Group

Established a new regional headquarters in Downtown Dubai in February 2024, expanding workforce from 12 to over 400 employees. Aims to double GCC business within five years with brands like Ferrero Rocher, Nutella, and Kinder.

Mondelez International (Cadbury)

Major presence with Cadbury Dairy Milk and other confectionery brands. Strong focus on localized marketing and seasonal assortments for regional festivals.

Nestlé

Introduced premium “Les Recettes De L’Atelier” line in UAE featuring sustainably sourced cocoa and exclusive flavor profiles. Partnered with Dubai AI Campus in 2024 to develop AI tools for identifying product innovation opportunities.

Lindt & Sprüngli

Inaugurated flagship boutique in Dubai Mall showcasing dark and milk chocolates with live chocolate crafting workshops. Released limited-edition “Dubai Style Chocolate” bars in Europe in 2025 that sold out within hours. Launched official UAE e-shop in March 2025.

Godiva Chocolatier

Opened chocolate café and retail outlet in Dubai Mall in September 2024, showcasing the UAE’s first chocolate fountains. Strong presence in luxury gifting segment with iconic gold boxes.

Premium Local and Regional Brands

Al Nassma

The World’s First Camel Milk Chocolate

Founded in Dubai in 2008, Al Nassma produces unique luxury chocolates using camel milk, which contains less fat and more vitamins than cow’s milk. Signature products include “Arabia” blend with cardamom and cinnamon, and macadamia-orange bars. Available at Dubai Duty Free and hotel boutiques.

Mirzam Chocolate Makers

Award-Winning Bean-to-Bar Artisan

Dubai-based chocolatier sourcing high-quality cocoa beans from Vietnam, Madagascar, Papua New Guinea, India, and Tanzania. Received five Academy of Chocolate Awards in 2025 for single-origin dark chocolate and vegan collections. Features Middle Eastern flavors including rose petals, saffron, figs, and dates. Uses traditional stone grinding methods over several days.

Patchi

Lebanese Luxury Chocolatier

Operating elegant boutiques across UAE since the 1970s, Patchi is renowned for handcrafted pralines wrapped in luxurious packaging. Operates approximately 62 branches in Saudi Arabia and numerous locations in UAE malls and airports. Premium gift sets range from AED 75 to AED 1,185.

Bateel

Premium Date and Chocolate Specialist

Backed by LVMH, Bateel plans to expand from 200 to over 500 stores by 2029. Specializes in premium dates dipped in chocolate and gourmet fillings. Product pricing ranges from AED 22 for Dubai Chocolate Bar to AED 1,185 for premium gift sets.

Forrey & Galland

Luxury Gift Chocolate Brand

Known for handcrafted chocolates with sophisticated packaging. Popular choice for corporate gifting and special occasions.

Max Chocolatier

Artisanal Chocolate Boutique

Offers premium handmade chocolates with unique flavor combinations and elegant presentation.

Market Drivers and Growth Factors

1. High Disposable Income and Affluent Consumer Base

With a GDP per capita exceeding USD 43,000, the UAE possesses one of the world’s highest purchasing power levels. This affluence enables residents to treat chocolate not merely as a snack but as a luxury indulgence. Consumers in Dubai and Abu Dhabi prioritize brand prestige and ingredient quality over price, creating fertile ground for international luxury brands and high-end local boutiques to thrive.

2. Tourism and Duty-Free Purchases

As a premier global destination, Dubai alone attracts over 16 million international visitors annually. Tourism drives substantial chocolate sales through:

- Dubai International Airport duty-free shops carrying extensive premium chocolate selections

- Hotel boutiques and luxury mall retailers targeting tourists seeking authentic UAE souvenirs

- Chocolate tourism experiences at factories like Mirzam and Al Nassma

- Dubai Duty Free selling over 1.2 million units of viral “Dubai Chocolate” bars in 2024 alone

3. Cultural Gifting Traditions

The UAE’s gifting culture during Ramadan, Eid, Diwali, National Day, weddings, and corporate events drives substantial demand for premium presentation and packaging. Chocolate is deeply integrated into hospitality and celebration customs across the multicultural population.

📈 The Viral Dubai Chocolate Phenomenon

The 2024-2025 “Dubai Chocolate” trend featuring pistachio cream, tahini, and kataifi pastry generated over 120 million TikTok views and disrupted international markets. This viral success:

- Drove pistachio prices up 34% globally, from USD 7.65 to USD 10.30 per pound

- Prompted major brands like Lindt, Häagen-Dazs, Trader Joe’s, and Crumbl Cookies to create pistachio-inspired products

- Positioned the UAE as a chocolate trendsetting hub rather than merely a consumption market

- Resulted in U.S. pistachio supplies falling 20% between February 2024 and February 2025

- Led Iran to export 40% more pistachios to UAE from September 2024 to March 2025

4. Health-Conscious Consumer Evolution

Health awareness is reshaping consumption patterns in the UAE:

- Dark Chocolate Growth: Expanding at 7.51% CAGR, outpacing milk and white variants by approximately 220 basis points. Consumers recognize antioxidant benefits and health properties of 70%+ cocoa content.

- Functional Chocolate: Growing demand for sugar-free options using stevia and monk fruit, vegan formulations, and products incorporating superfoods like quinoa and chia seeds

- Premium Health Positioning: Consumers justify chocolate as wellness investments rather than occasional treats

5. E-Commerce and Digital Retail Expansion

Online retail is growing at 6.60% CAGR through 2031:

- Platforms like Talabat, Noon, and Carrefour Now offering 30-minute delivery commitments

- Brand-direct e-commerce from Lindt, Patchi, and others

- AI-powered vending machines with personalized recommendations in malls and airports

- Social media-led impulse buying through Instagram and TikTok

Consumer Trends and Preferences

Chocolate Type Preferences

| Chocolate Type | Market Share (2025) | Growth Rate | Key Demographics |

|---|---|---|---|

| Milk Chocolate | 43% | Moderate | Families, younger consumers |

| Dark Chocolate | 40% | 7.51% CAGR (Fastest) | Health-conscious, affluent consumers |

| White Chocolate | 12% | Slower | Niche segment |

| Single-Origin | 5% | 6.70% CAGR | Premium consumers valuing traceability |

Product Format Preferences

Countlines (snack bars) dominate due to the “on-the-go” consumption culture in urban centers like Dubai and Abu Dhabi, where portability and convenience are paramount. This segment is bolstered by social media-led impulse buying and single-serve portions appealing to Gen Z demographics who prioritize calorie control alongside indulgence.

Pralines and truffles experience significant growth at 6.74% CAGR (2026-2031), driven by popularity as premium gifting options during festive occasions.

Unique Middle Eastern Flavors

The UAE market embraces regional ingredients that differentiate it from traditional European chocolate markets:

- Dates: Chocolate-covered dates and date-filled chocolates

- Camel Milk: Unique to UAE, offering distinctive taste and nutritional benefits

- Pistachio: Major trend ingredient, especially after Dubai Chocolate phenomenon

- Saffron: Premium ingredient adding luxury positioning

- Rose Water & Rose Petals: Traditional Middle Eastern flavoring

- Cardamom: Aromatic spice popular in regional cuisine

- Tahini: Sesame paste providing nutty depth

- Kunafa/Kataifi: Crispy shredded phyllo pastry adding texture

Distribution Channels

Supermarkets and Hypermarkets (35.55% Market Share)

Leading retailers dominating chocolate sales:

- Carrefour: Offers extensive range including Lindt, Godiva, Patchi, Toblerone, Hershey’s, Nestlé, and Ferrero Rocher in gourmet sections

- Lulu Hypermarket: Competitive pricing and wide selection

- Spinneys: Premium positioning with specialty chocolates

- Waitrose: High-end selection targeting affluent consumers

These retailers attract consumers through extensive product assortments, competitive promotional pricing, and strategically placed impulse-purchase items at checkouts and end-caps.

Online Retail (Growing 6.60% CAGR)

E-commerce platforms are rapidly closing the gap with traditional retail through:

- Quick-commerce services offering 30-minute delivery

- Brand direct-to-consumer platforms

- Specialized chocolate marketplaces

- Social commerce through Instagram and TikTok

Specialty Boutiques and Flagship Stores

Luxury brands operate standalone boutiques in premium locations:

- Dubai Mall (Lindt, Patchi, Godiva, Mirzam outlets)

- Mall of the Emirates

- City Walk

- Hotel lobbies and luxury developments

Duty-Free and Airport Retail

Dubai International Airport represents a significant channel for both local specialty chocolates (Al Nassma, Mirzam, Patchi) and international luxury brands, catering to 16+ million annual visitors.

Challenges and Market Constraints

1. Rising Raw Material Costs

Cocoa prices nearly doubled between 2024 and 2025 due to:

- Climate change impacting cocoa-growing regions in West Africa

- Supply chain disruptions

- Increased global demand

Additionally, the pistachio shortage driven by Dubai Chocolate trend and drought conditions in Iran and Turkey has increased ingredient costs for specialty products.

2. Regulatory Environment

Abu Dhabi’s Nutri-Mark labeling system grades products on sugar and fat content, prompting producers to reformulate toward darker or reduced-sugar profiles to meet health standards and consumer expectations.

3. Climate and Logistics

Desert climate and absence of local cocoa farming necessitate:

- Sophisticated cold-chain logistics

- Climate-controlled storage and retail environments

- Import dependencies from Switzerland, Belgium, France, Italy, and cocoa-producing countries

4. Intense Competition

The market faces competition from both established global brands and emerging artisanal players, requiring continuous innovation in flavors, packaging, and marketing strategies.

Future Outlook and Opportunities

Premiumization Trend Continuation

Premium chocolate segment is projected to grow at nearly 7% CAGR through 2030, significantly outpacing mass-market trajectory. This shift reflects:

- Growing consumer preference for experiential retail

- Appeal of provenance storytelling and single-origin cocoa

- Demand for artisanal craftsmanship and limited editions

- Sustainability and ethical sourcing becoming purchasing factors

Technology Integration

- AI and Data Analytics: Brands like Nestlé partnering with Dubai AI Campus to identify innovation opportunities

- Smart Vending: AI-powered machines with personalized recommendations

- AR/VR Experiences: Virtual tasting experiences educating consumers about chocolate origins and production

- Blockchain: Traceability for ethically sourced ingredients

Expansion of Local Manufacturing

Growing trend toward establishing local production facilities:

- Pure Ice Cream Company broke ground on new facility in Dubai Industrial City in May 2025

- Increased focus on UAE as regional chocolate innovation and export hub

- Development of specialized chocolate-making infrastructure

Sustainable and Ethical Sourcing

Consumers increasingly prioritize:

- Fair-trade certified cocoa

- Organic certifications

- Carbon-neutral production methods

- Eco-friendly packaging solutions

Cross-Category Innovation

Dubai Chocolate trend demonstrates potential for flavor profile expansion into:

- Beverages (pistachio lattes, chocolate-infused specialty coffee)

- Ice cream and gelato

- Bakery products (croissants, macarons, cookies)

- Spreads and toppings

Key Takeaways

The UAE chocolate market presents significant opportunities for growth and innovation in 2026 and beyond. With projected growth to USD 739.39 million by 2031, the market is characterized by:

- Strong demand for premium, artisanal, and health-focused products

- Robust tourism driving duty-free and souvenir purchases

- Cultural gifting traditions creating consistent seasonal demand

- Growing e-commerce and digital retail channels

- Successful integration of Middle Eastern flavors creating global trends

- Opportunities for both mass-market efficiency and premium positioning

Success in this market requires understanding the sophisticated, multicultural consumer base, investing in quality and innovation, and leveraging both traditional retail and emerging digital channels. The UAE’s position as a chocolate trendsetter, demonstrated by the viral Dubai Chocolate phenomenon, underscores its strategic importance in the regional and global chocolate industry.

How RADAD International Supports the UAE Chocolate Market

Product Portfolio for UAE Manufacturers

| Product | Application | Specification |

| Alkalized Cocoa Powder | Chocolate beverages, ice cream, baked goods | 10/12% & 20/22% fat, various pH levels |

| Natural Cocoa Powder | Premium baking, health products | High-flavanol, single-origin options |

| Cocoa Butter | Chocolate manufacturing, cosmetics | Deodorized and natural grades |

| Cocoa Liquor/Mass | Industrial chocolate production | Various cocoa origins |

| Chocolate Couverture | Artisan and industrial use | Dark, milk, and white varieties |

Frequently Asked Questions (FAQ)

About Radad International: RADAD International is a leading global supplier of premium cocoa products, serving chocolate manufacturers across the Middle East, including the UAE, Saudi Arabia, and Kuwait. With decades of expertise in cocoa sourcing, processing, and logistics, we provide consistent quality, competitive pricing, and exceptional technical support to help our clients succeed in dynamic markets.

For more information about market opportunities, partnerships, or chocolate products, please contact Radad International.

Disclaimer: Market data and projections are based on available industry reports and research publications. Actual market performance may vary based on economic conditions, regulatory changes, and consumer behavior shifts.